Market overview

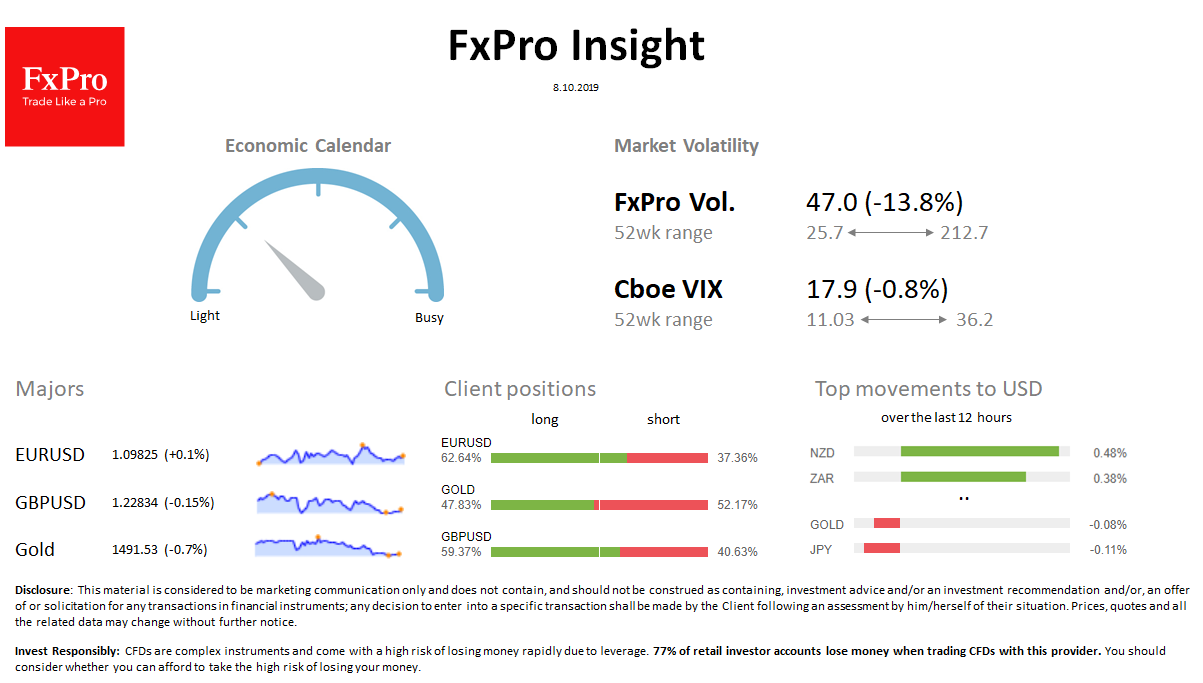

FX: The dollar mainly maintains its position at 98.61 on DXY, after rising 0.2% on Monday. NZD and ZAR are the leaders in growth to USD, adding 0.4-0.5% overnight. JPY and GBP slightly lose to USD.

Stocks: S&P500 Futures remain near Monday’s close, losing 0.4% week to date. MSCI World turned downward since the start of the European session. The VIX volatility index fell from 18 to 17.9.

Commodities: Brent is trading at $ 58.3, maintaining moderately positive dynamics since Thursday. Gold loses another 0.6% over last 24h to $ 1,493.

Crypto: Bitcoin received support on a downturn at $ 7,800 and is trading at $ 8,200 at the time of writing. Top 10 altcoins add from 3% to + 6% in the last 24 hours.

Important upcoming events (GMT):

08:30 GBP [!!] BoE Member Andy Haldane Speaks 12:15 CAD [!!] Canada Housing Starts 12:30 USD [!!] US Producer Price Index 18:30 USD [!!!] Fed Chairman Powell Speaks