Market overview

FX: The dollar is recovering after a slight decline on Friday. NZD is the only major that adds to USD this morning. TRY, PLN, NOK lose to USD.

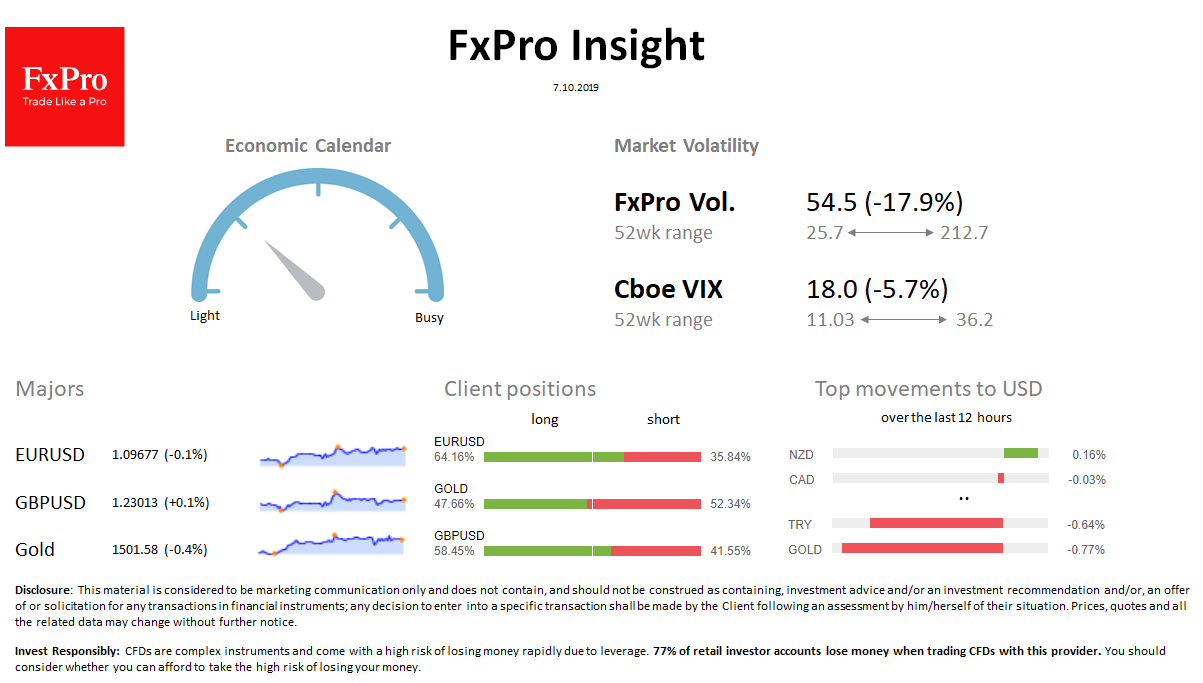

Stocks: S&P500 futures opened lower in the morning, shedding 0.4% after rising 1.4% on Friday. MSCI World is almost unchanged since the beginning of the day; Hang Seng declined 1.2% since the start of the day. The VIX volatility index fell from 19.6 to 18.0.

Commodities: Brent is trading at $ 58.1, maintaining positive momentum since Thursday. Gold loses 0.4% to $ 1,504.

Crypto: Bitcoin develops a decline to $ 7,850. Top 10 altcoins vary from -1.5% to + 5% in the last 24 hours.

Important upcoming events (GMT):

08:30 EUR [!!] Euro area Sentix Investor Confidence 17:00 USD [!!!] Federal Reserve Chairman Powell Speaks 01:45 CNH [!!] China Markit Services PMI 04:10 GBP [!!!] BOE Governor Mark Carney Speaks