Market overview

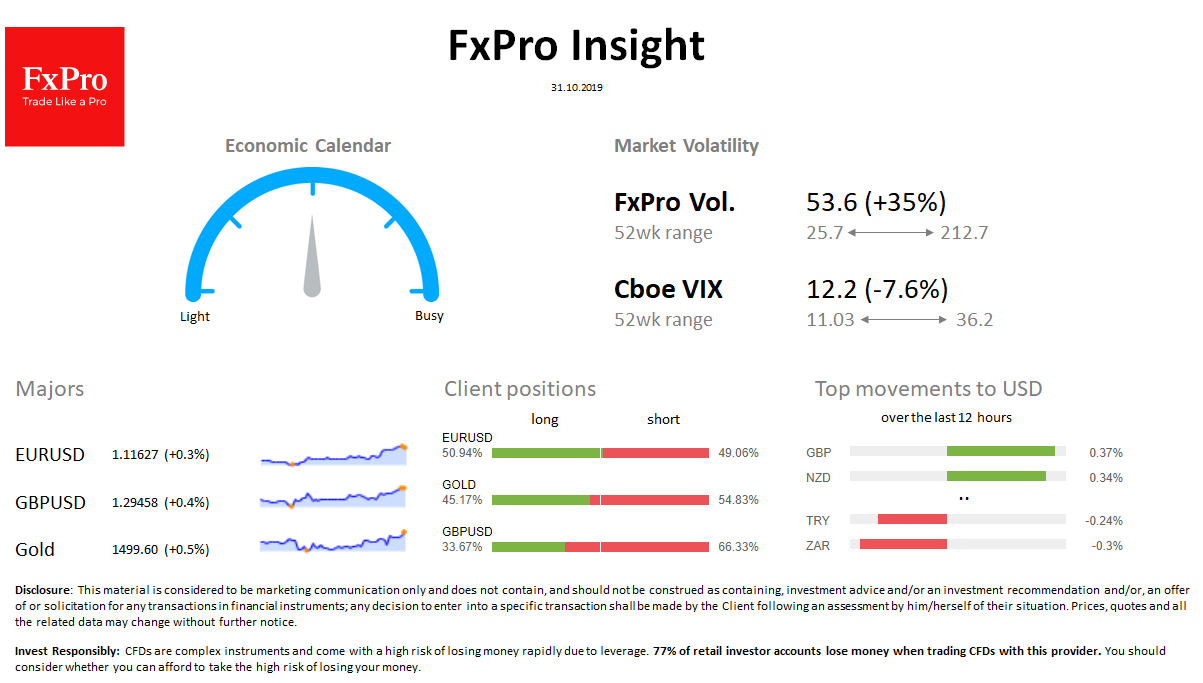

FX: The dollar lost 0.4% after the Fed’s rate decision to 97.1 on DXY. GBPUSD is up 0.4% since the start of the day, EURUSD is up 0.1% to 1.1165. Forex market volatility has grown, and the number of open positions for the sale of the pound in FxPro grew.

Stocks: Futures for S&P500 updated historic highs to 3,059 (+ 0.56% over last 24h). MSCI World added 0.4%. The VIX volatility index fell from 13.2 to 12.2.

Commodities: Brent lost $0.4 per day, trading at $ 60.6. The weakness of the dollar helped gold rise to $ 1,500.

Crypto: Bitcoin loses 1% to $ 9100. The top 10 altcoins range from -4.7% (BSV) to -0.9% (BNB).

Important upcoming events (GMT):

10:00 EUR [!!!] EA Consumer Price Index 12:30 CAD [!!!] Canada Gross Domestic Product 12:30 USD [!!] US Personal Income / Outlays