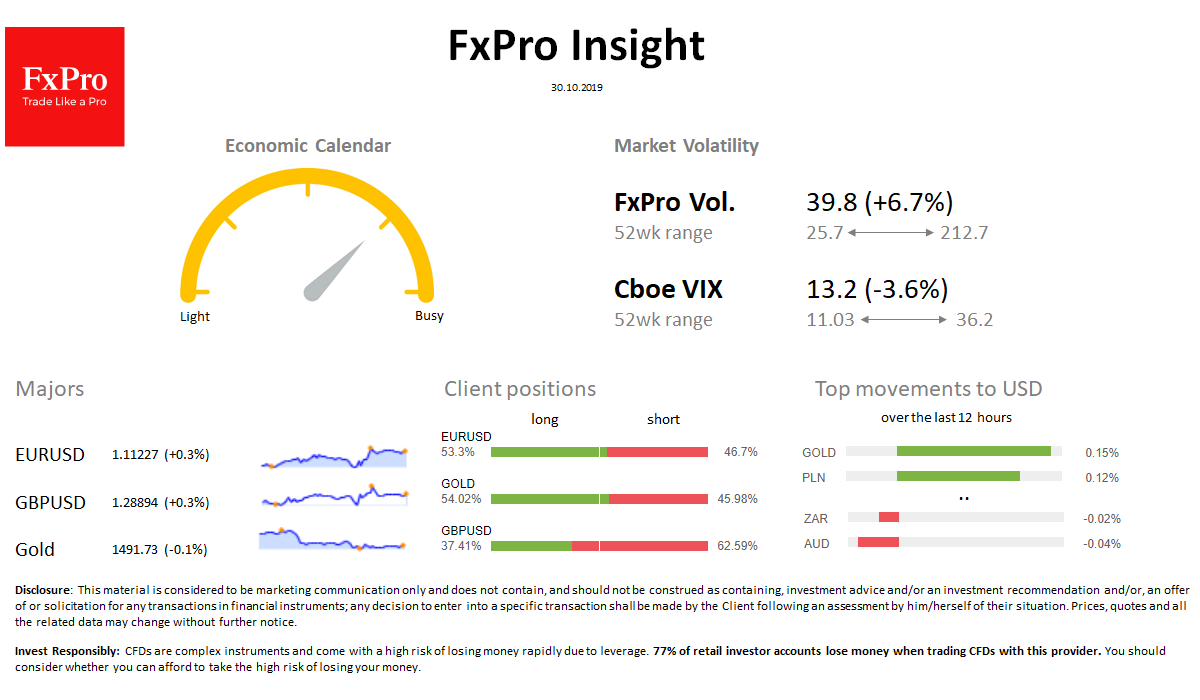

Stocks: S&P500 futures remain close to historical highs, almost unchanged since Monday’s close. MSCI World without significant changes per day. VIX Volatility Index tumbled to 13.2.

Commodities: Brent added $1, trading at $ 61. Gold traded near $1494 ahead of major publications.

Crypto: Bitcoin dipped to $9000, losing 3.5% per day. The top 10 altcoins range from -5.8% (TRX) to 1.2% (BCH).

Important upcoming events (GMT): 12:15 USD [!!] US ADP Non-Farm Employment Change 12:30 USD [!!] US GDP 1st estimate 14:00 CAD [!!!] BoC Overnight Rate 18:00 USD [!!!] FOMC Rate Decision 18:30 USD [!!!] FOMC Press Conference