Market overview

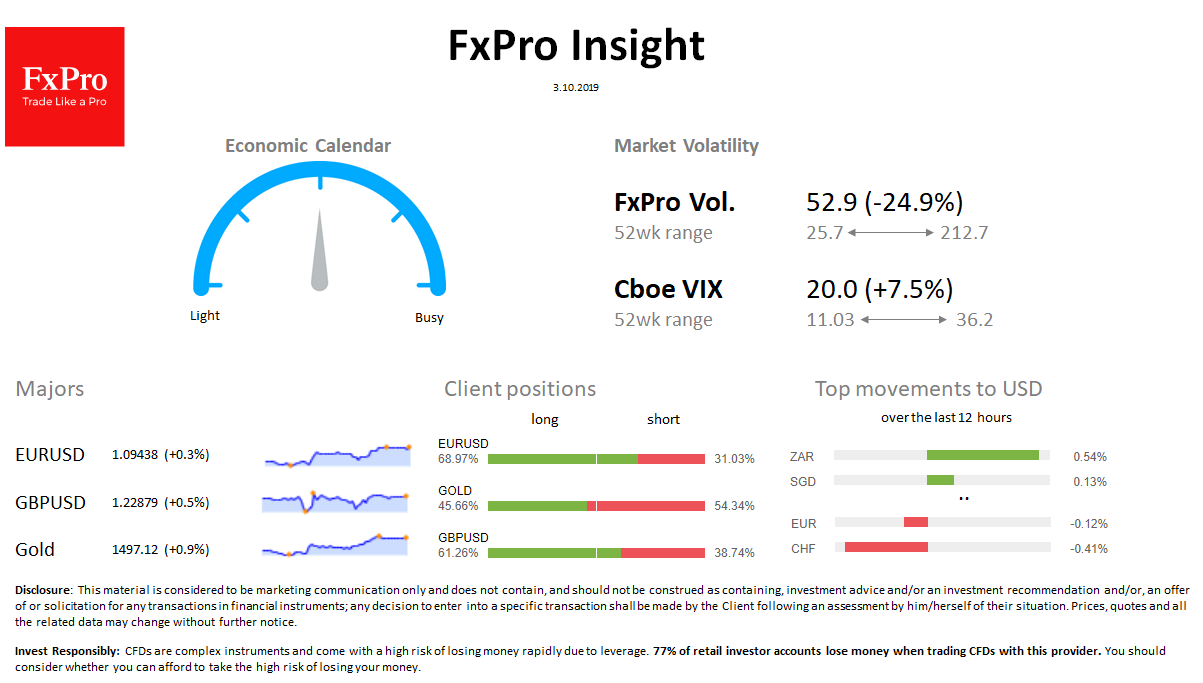

FX: Moderate demand for yielding currencies versus safe-heavens on Thursday. ZAR, SGD, AUD are the leaders in the growth to USD, while CHF and EUR are sinking.

Stocks: S&P500 futures add 0.2% this morning to 2890, but lower by 1% over last 24h. MSCI World loses 0.2%; Hang Seng adds 1.3%. Nikkei225 is in small decline. The VIX volatility index rose to 20, reaching the 2-months highs on Wednesday.

Commodities: Brent traded near $57.50 having lost another $1 overnight. Gold went back to $1,500.

Crypto: Bitcoin has stabilized near $ 8,200. Top 10 altcoins vary from -1% to + 2% in the last 24 hours.

Important upcoming events (GMT):

08:00 EUR [!!] Euro area Services PMI 08:30 GBP [!!] U.K. Services PMI 12:30 USD [!!] U.S. Unemployment Claims 14:00 USD [!!!] U.S. ISM Non-Manufacturing PMI