Market overview

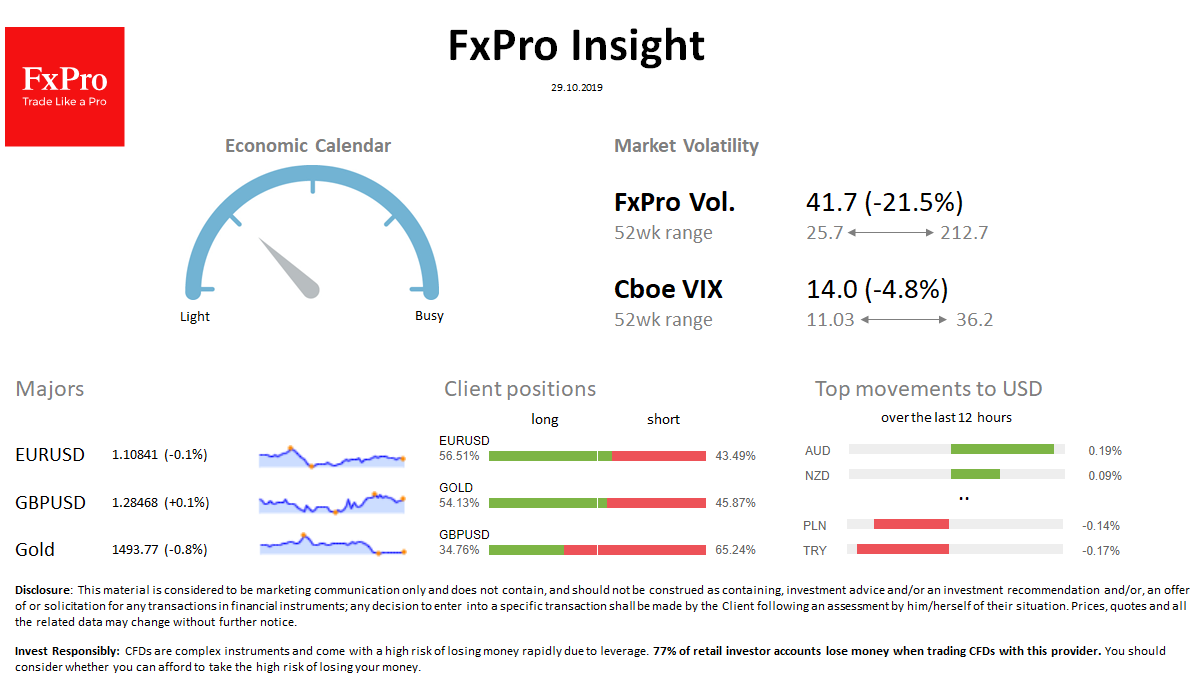

FX: The dollar maintains a mini-trend for growth from 3-month DXY lows, rose to 97.6 this morning. EURUSD, GBPUSD lost about 0.1% since the beginning of the day. Forex market volatility continues to fall ahead of important news in the second half of the week. AUD is in the lead over USD, but adds only 0.2%. TRY has given about the same since the beginning of the day.

Stocks: Futures for S&P500 suspended their growth after updating all-time highs on Monday. MSCI World adds 0.4% per day. The VIX volatility index is near 13.3, pushing from the lows at 12.6 yesterday.

Commodities: Brent develops a pullback, dropping 1.1% per day to $ 60. The optimism of the stock market put pressure on gold quotes, which lost 0.7% to $ 1,494.

Crypto: Bitcoin is trading near $ 9400, almost unchanged in a day. The top 10 altcoins range from + 0.5% (XRP) to + 10% (BCH).

Important upcoming events (GMT):

09:30 GBP [!!] UK Net Lending to Individuals 13:00 USD [!] US S&P/Case-Shiller 20 City 14:00 USD [!!!] US CB Consumer Confidence