Market overview

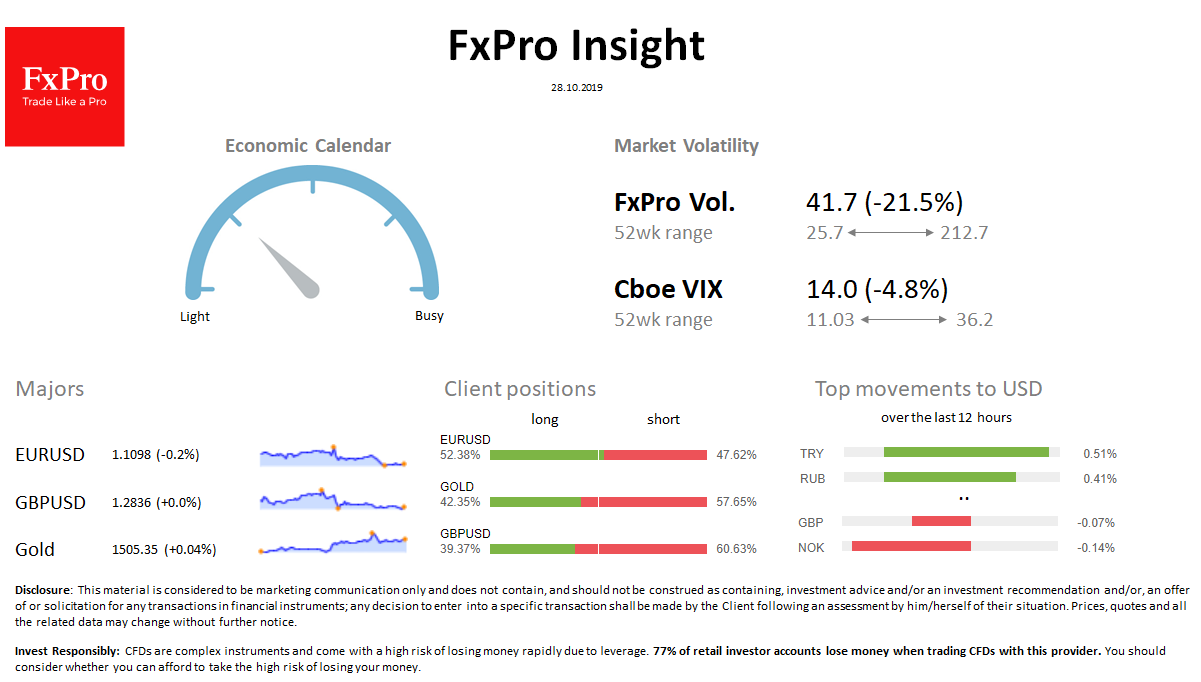

FX: Over the last week, the dollar developed its rebound from 3-month lows on DXY, rising to 97.5. EURUSD, GBPUSD, adjusting previous week’s decline. TRY is the leader in growth against USD, protective CHF, JPY under some pressure. Forex market volatility at lows since July.

Stocks: Futures for S&P500 traded near its all-time highs on European trading session start. MSCI World is up 0.4% since Friday. The VIX volatility index fell from 13.7 to 13.3.

Commodities: Brent declined to $ 61.4 after touching monthly highs at $ 61.7. Gold returned to an area above $ 1,500, although it failed to cling to levels above $ 1,515 on Friday.

Crypto: On Monday morning BTCUSD jumped to $9800, but gave up part of the increase, declined to 9350. The top 10 altcoins vary from + 0.4% (BTC) to + 21% (TRX).

Important upcoming events (GMT):

15:00 EUR [!!] Outgoing ECB President Draghi speaks 19:00 GBP [!!!] Parliament Vote on possible election