Market overview

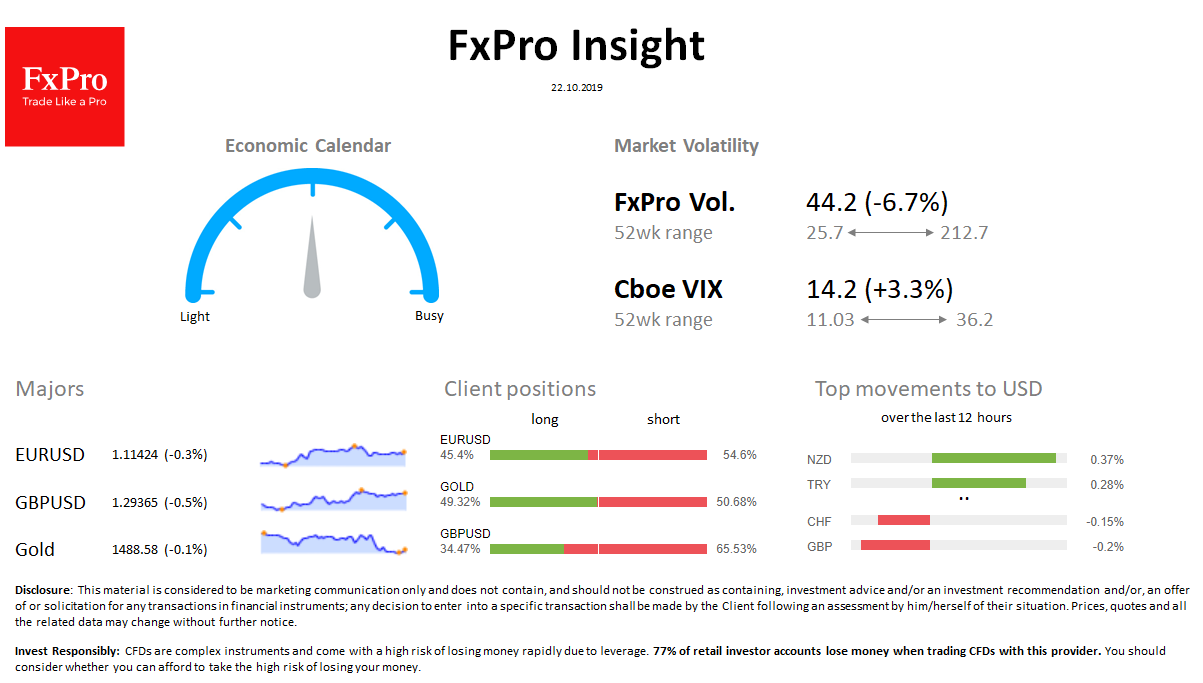

FX: The dollar is showing growth attempts after a prolonged weakening. DXY rose to 97.0, almost unchanged in a day. GBPUSD warily rolls back from levels above 1.30 yesterday, trading near 1.2930 at the time of writing ahead of a meaningful vote in Parliament. Demand for “yielding” currencies is increasing: NZD, TRY are the leaders in growth, while CHF is losing ground.

Stocks: S&P500 Futures lost their steam after growth overnight, retreating to 3000 after touching 3013 earlier in the morning. MSCI World adds 0.6% per day. The VIX volatility index remained near 14.1.

Commodities: Brent declined overnight from $ 58.8 to $ 58.6. Gold is trading near $ 1,488, staying in a limited range.

Crypto: Bitcoin has not changed in a day, remaining at $ 8,200. The top 10 altcoins range from -0.1% (ETH) to + 13% (BSV).

Important upcoming events (GMT):

12:30 CAD [!!] Canada Retail Sales 14:00 USD [!!] US Existing Home Sales 18:00 GBP [!!!] UK Parliament Brexit Vote