Market overview

FX: The dollar fell 0.3% per day to 97.7 DXY. On the market, the dollar weakened after weak data from the US and optimism around the Brexit deal. Sensitive to demand for risks, ZAR, AUD add about 0.5%. GBPUSD decreased by 0.2% after the 1.2% intraday rally on Wednesday.

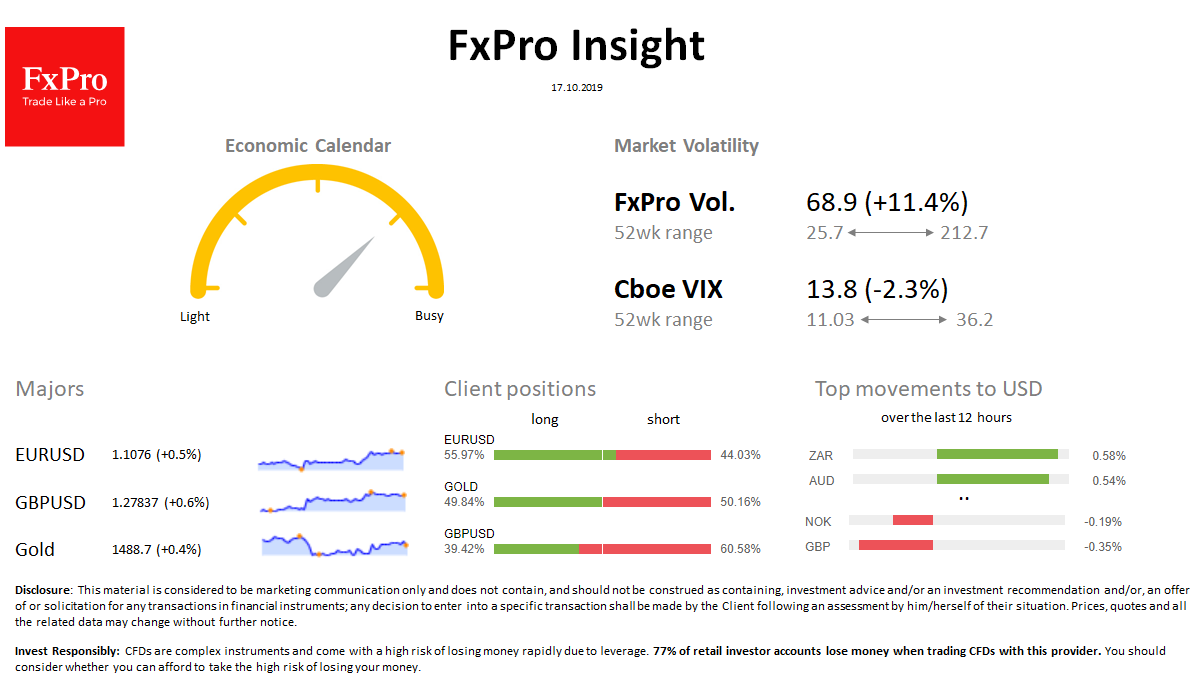

Stocks: S&P500 futures remain at 2990, little changed over the last 24h. MSCI World virtually unchanged. The VIX volatility index fell from 14.1 to 13.8.

Commodities: Brent is trading at $58.8, almost unchanged over the day. Gold declined to $1487 after an unsuccessful attempt to go above $1490 on Wednesday.

Crypto: Bitcoin lost 2% per day, remaining at $8,000. The top 10 altcoins ranged from -5.0% (TRX) to -0.8% (BNB).

Important upcoming events (GMT): All day GBP [!!!] European Council Meeting 11:30 GBP [!!] UK Retail Sales 15:30 USD [!!] US Building Permits 16:15 USD [!!] US Industrial Production 05:00 CNH [!!!] China Real GDP