Market overview

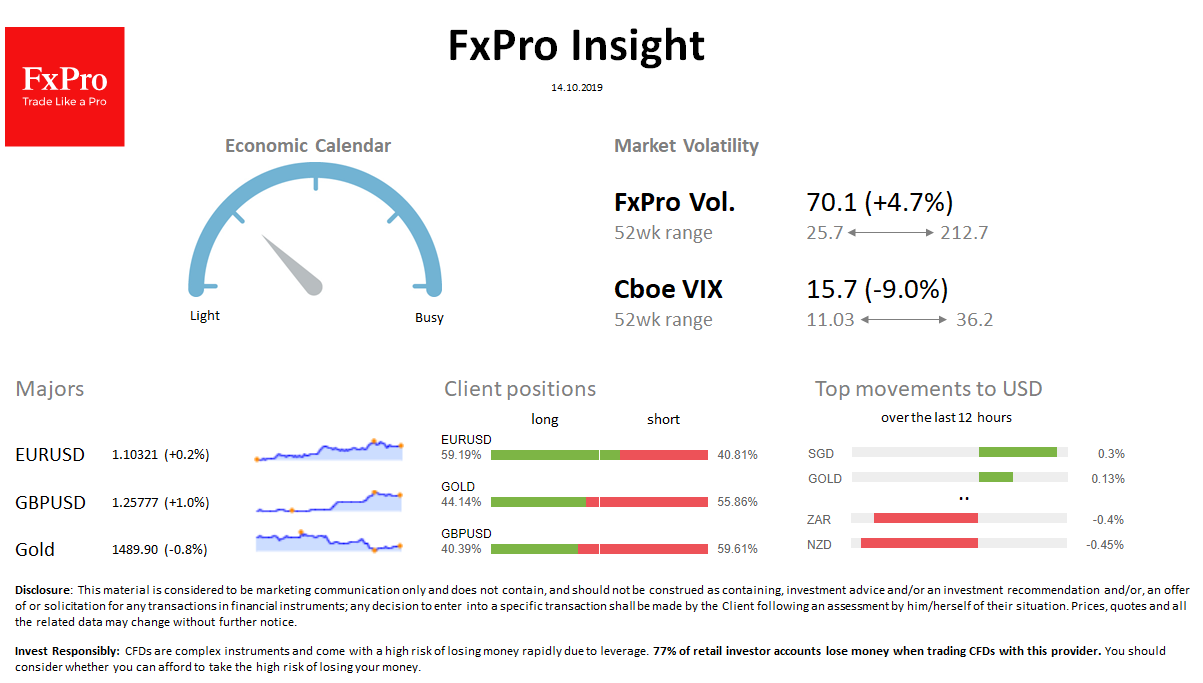

FX: The dollar added 0.2% on Monday morning to 98.2 on DXY after failing 0.8% at the end of last week. SGD, PLN are the leaders in the growth to USD, adding 0.2%. NZD, ZAR gave back some gains next week, dropped 0.4%.

Stocks: S&P500 futures remain near Friday’s close at 2970. MSCI World is up 0.8% since Friday morning. The optimism around the US-China talks is restrained by weakening economic indicators. The VIX volatility index fell from 17.3 to 15.7.

Commodities: Brent is traded at $ 50.8 by 10:00 GMT, losing 0.8% from the start of the day. Gold declined to $ 1,490 due to lower demand for safe-harbours.

Crypto: Bitcoin almost did not change in a day, remaining at $ 8300. The top 10 altcoins range from -3.6% (BSV) to + 3.8% (TRX).

Important upcoming events (GMT):

12:00 EUR [!!] Eurozone Industrial production in the 03:30 AUD [!!!] RBA Monetary Policy Meeting Minutes 04:30 CNH [!!!] China Consumer Price Index