Market overview

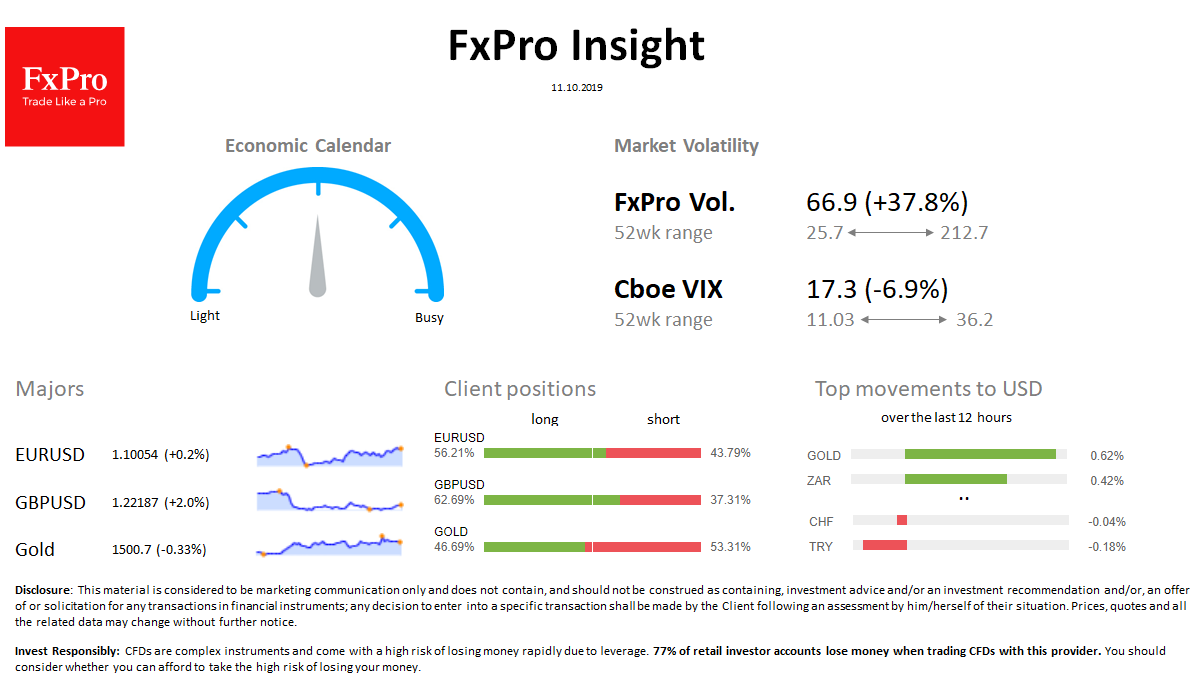

FX: The dollar lost 0.4% per day to 98.35 DXY amid a recovery in demand for risks. An increase in demand for riskier assets causes a further weakening of the dollar against most major currencies. AUD and ZAR are the leaders in the growth to USD, adding 0.4% this morning. TRY and CHF lost within 0.2%.

Stocks: S&P500 futures remain in green, added 1.5% over the past day. MSCI World is increased by 1.5% over the last 24h, on optimism around the US-China talks. The VIX volatility index fell from 18.6 to 17.3.

Commodities: Brent is trading at $ 60.3, adding about 4%. Gold fell to $ 1,500 due to lower demand for safe-harbours.

Crypto: Bitcoin loses 33% to $ 8,350 in 24 hours. The top 10 altcoins ranged from -3.4% (BCH) to + 0.7% (Tether).

Important upcoming events (GMT):

10:00 EUR [!!!] ECB President Draghi Speaks 12:30 CAD [!!!] Canada Employment Change 14:00 USD [!!] US Consumer Sentiment