Market overview

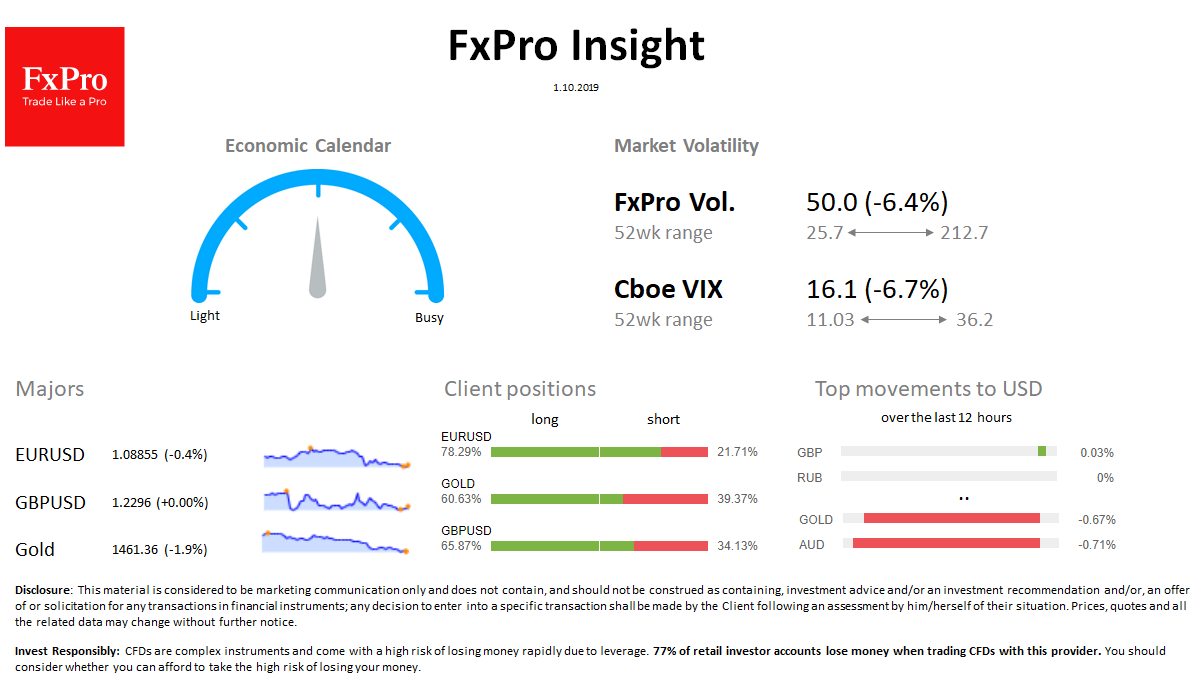

FX: The dollar index climbed another 0.4% to 99.2. EURUSD lost 0.5% to 1.0880 before European open. GBPUSD virtually not changed overnight, remaining at 1.2270 in anticipation of the presentation of the Brexit plan before UK Parliament.

Stocks: S&P500 futures turned to rise on Monday to 2990. MSCI World has returned to levels since the beginning of the day after rising 0.1%; major Asian indices are adding within 0.2%. The VIX volatility index fell from 17.2 to 16.1.

Commodities: Brent fell to $59.20 and remains below $ 60.0, having completely recovered the jump on explosions in the SA. Gold develops a sharp weakening, dropped by another 1.8% to $ 1460.

Crypto: Bitcoin is growing at 7% per day, trading at $ 8400. Top-10 altcoins add from 5% to 8% in the last 24 hours.

Important upcoming events (GMT):

08:00 EUR [!!] Euro area Manufacturing PMI 09:00 EUR [!!] Euro area CPI 12:30 CAD [!!!] Canada GDP 14:00 USD [!!!] ISM Manufacturing PMI