Market overview

FX: The dollar index remains near 97.7, tightly tied to the news on trade talks progress. GBPUSD turned to rise on Thursday morning from 1.2835 on reports of a possible phased reduction in US and Chinese tariffs; EURUSD traded at 1.1080, after touching 1.1055.

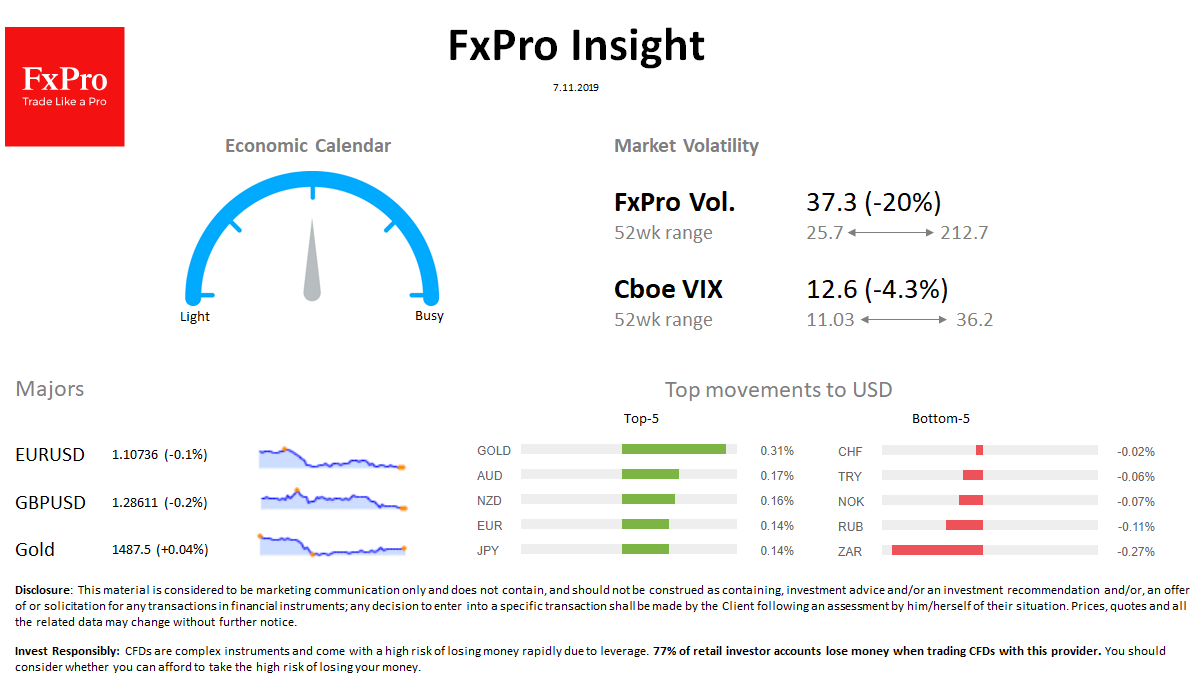

Stocks: Futures for S&P500 jumped 0.6% on reports from the Chinese officials about the possible signing of Phase 1 in the “coming weeks.” MSCI World is growing 0.2% overnight, updating its historical highs of 2018th. The VIX volatility index fell from 13.15 to 12.58.

Commodities: Brent loses $0.5 in 24 hours, trading near $ 61.7. Gold little changed, staying near 1487.

Crypto: Bitcoin dipped to $ 9,230. Top 10 altcoins in the green zone, varying from -7% (XLM) to -1.6% (XRP).

Important upcoming events (GMT):

13:00 EUR [!!] European Commission Economic Forecasts 15:00 GBP [!!!] BoE’s Rate decision and Monetary policy report 16:30 USD [!!] US Unemployment Claims