Market overview

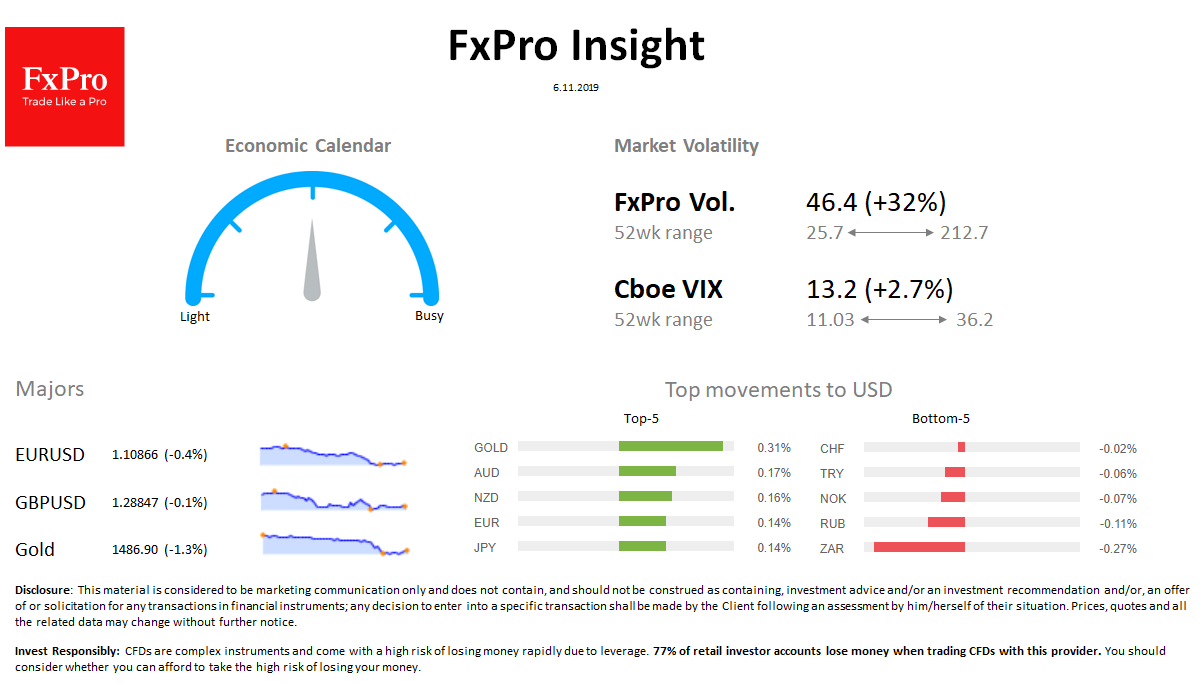

FX: The dollar index rose to 97.8 DXY on Tuesday, retreating 0.3% on Wednesday morning. GBPUSD almost unchanged, remaining at 1.2880; EURUSD is trading at 1.1080, pulling back after falling to 1.1060. The FX market volatility continues to increase.

Stocks: Futures for S&P500 retreated from all-time highs to 3073 (-0.4% from the peak). MSCI World loses 0.2% per day. The VIX volatility index rose from 12.8 to 13.15.

Commodities: Brent added $0.2 in 24 hours, trading close to $62.2. Gold lost 1.3% overnight to $1487.

Crypto: Bitcoin little changed, trading $9350. Top-10 altcoins in the green zone, varying from + 0.7% (XRP) to + 4.6% (BSV).

Important upcoming events (GMT):

13:00 USD [!!] FOMC Member Evans Speaks 14:30 USD [!!] FOMC Member Williams Speaks 15:30 WTI [!!] US Crude Oil Inventories