Market overview

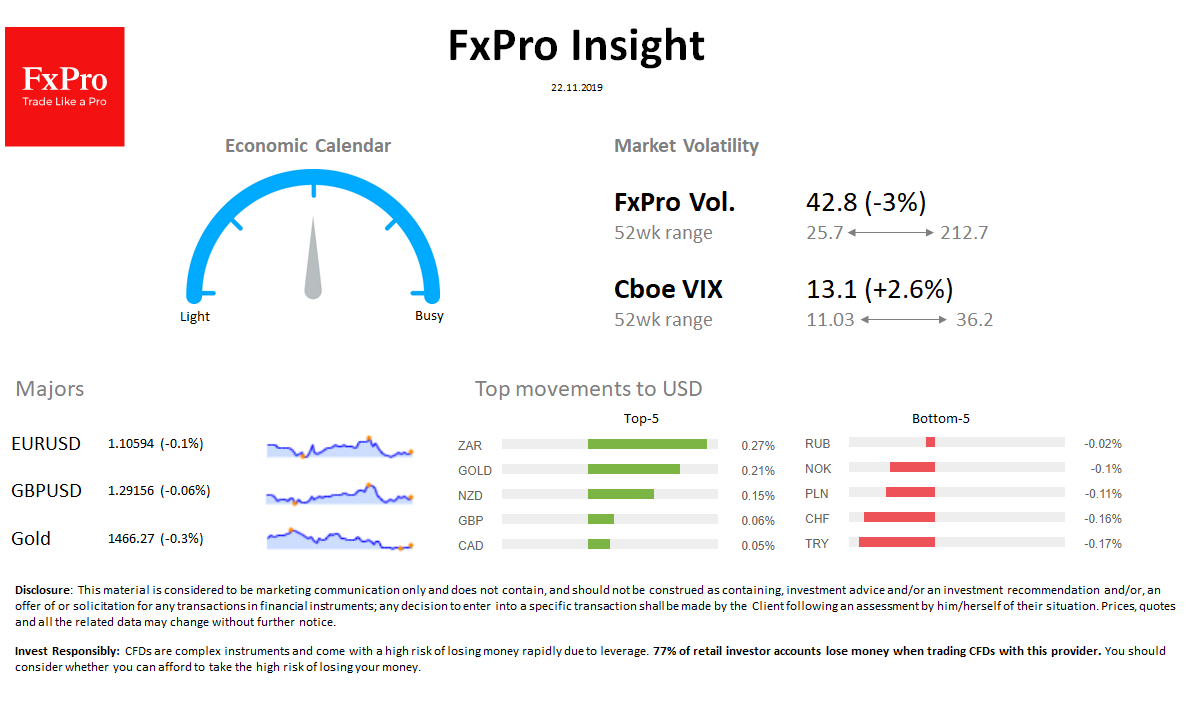

Forex: The dollar index little changed for the day. EURUSD stood near 1.1070 before European opening. GBPUSD pushed lower after another attempt to growth.

Stocks: S&P500 managed to turn to growth at the end of the day on Thursday, developing growth on Friday morning. Despite this, China A50 loses 1%. MSCI World adds 0.2% per day. The VIX volatility index has grown slightly from 12.8 to 13.13.

Commodities: Brent touched $ 63.0 (+ $ 1.5) on reports OPEC+ ready to extend quotas. Gold loses $ 2 to levels 24h ago, to 1470, but gained after the drop to $1463 the day before.

Crypto: Bitcoin’s downtrend intensified on Thursday. The course loses 6.5% per day to $ 7500, down 13 of the last 14 sessions. Top 10 altcoins in the red zone, varying from -11% (EOS) to -3% (XRP).

Important upcoming events (GMT):

13:30 CAD [***] Ca Retail Sales 15:00 USD [**] US UoM Consumer Sentiment 18:00 WTI [**] Baker Hughes U.S. Rig Count