Market overview

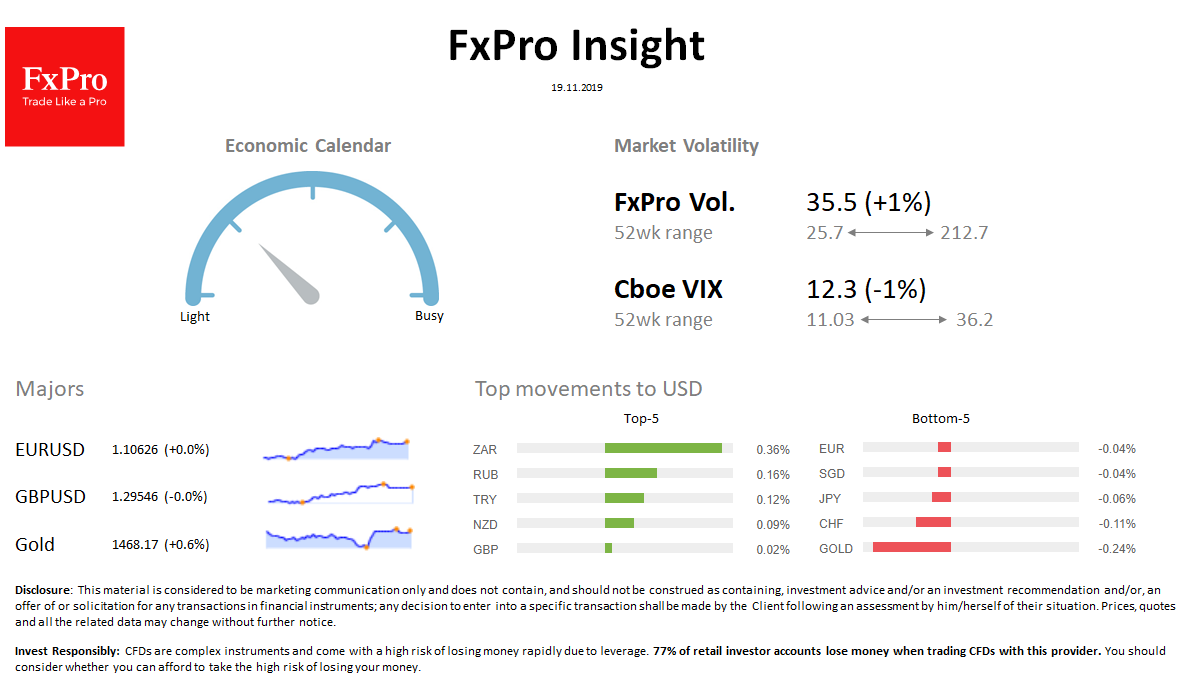

FX: The dollar index turned to growth after decline for the previous, got ground from this month lows at 97.5. EURUSD and GBPUSD, around 1.1060 and 1.2960. Profit in the US markets.

Stocks: Futures on the S&P500 rose to 3130, redeeming at the slightest attempt to fail. US indices are trading confidently in the overbought area. MSCI World adds 0.2% per day. Chinese bourses lead the growth. The VIX volatility index fell from 12.42 to 12.3.

Commodities: Brent is trading at $61.1, losing $ 1.6 to Monday morning. Gold growth on Monday stalled on the way to 1470.

Crypto: The price for bitcoin has dropped to $8,100. Top 10 altcoins in the red zone, varying from -8.2% (BSV) to + 3.3% (ETH).

Important upcoming events (GMT):

13:30 USD [!!] US Building Permits 14:00 USD [!!] FOMC Member Williams Speaks