Market overview

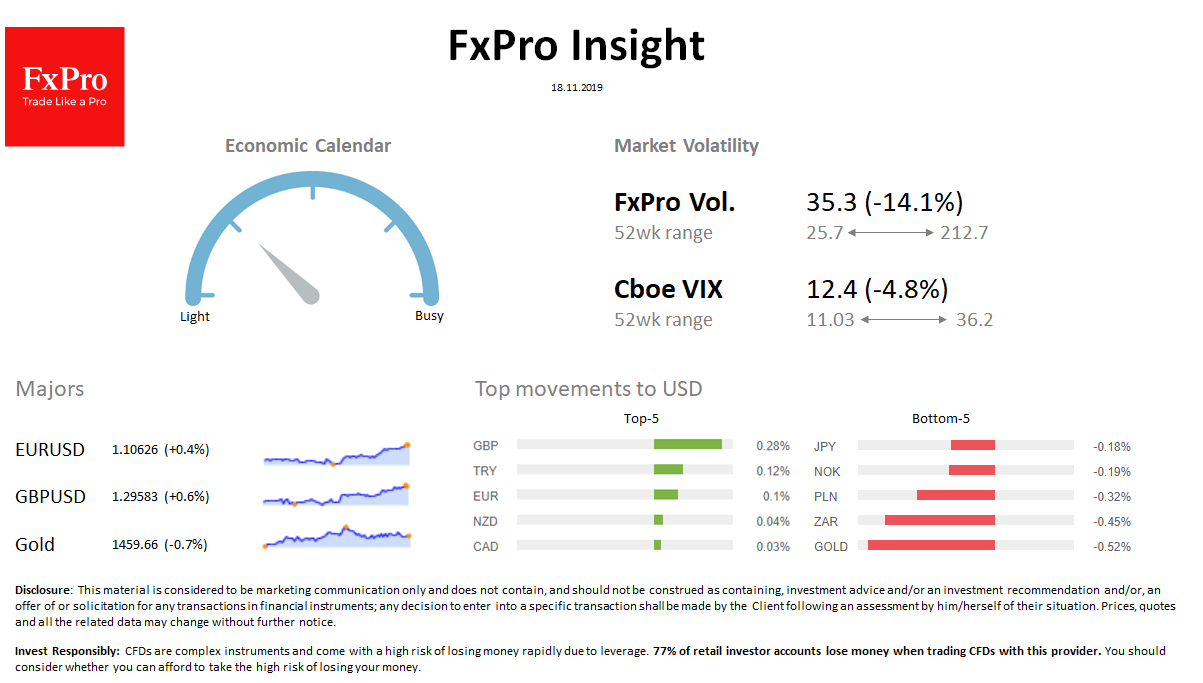

Forex: The dollar index maintain its decline, fell by another at 0.3% to 97.7. USDCNH continues to trade just above 7.0. EURUSD climbed above 1.10600 on the weakening dollar. GBPUSD overcame 1.2960, approaching the highs of last month at 1.30.

Stocks: Futures for S&P500 rose to 3125; Dow Jones exceeded 28,000. MSCI World adds 0.6% to Friday levels, Chinese indices turned to growth after drop on the last week. The VIX volatility index fell 13.04 to 12.42.

Commodities: Brent is trading at $ 62.7, added $0.9 since Friday morning. Gold pressure rose 0.8% to $1,458.

Crypto: The price of bitcoin fell to $8,400, decreasing 9 out of the last ten trading sessions. The top-10 altcoins are in the green zone, varying from -1.3% (XLM) to + 1.4% (ETH).