Market overview

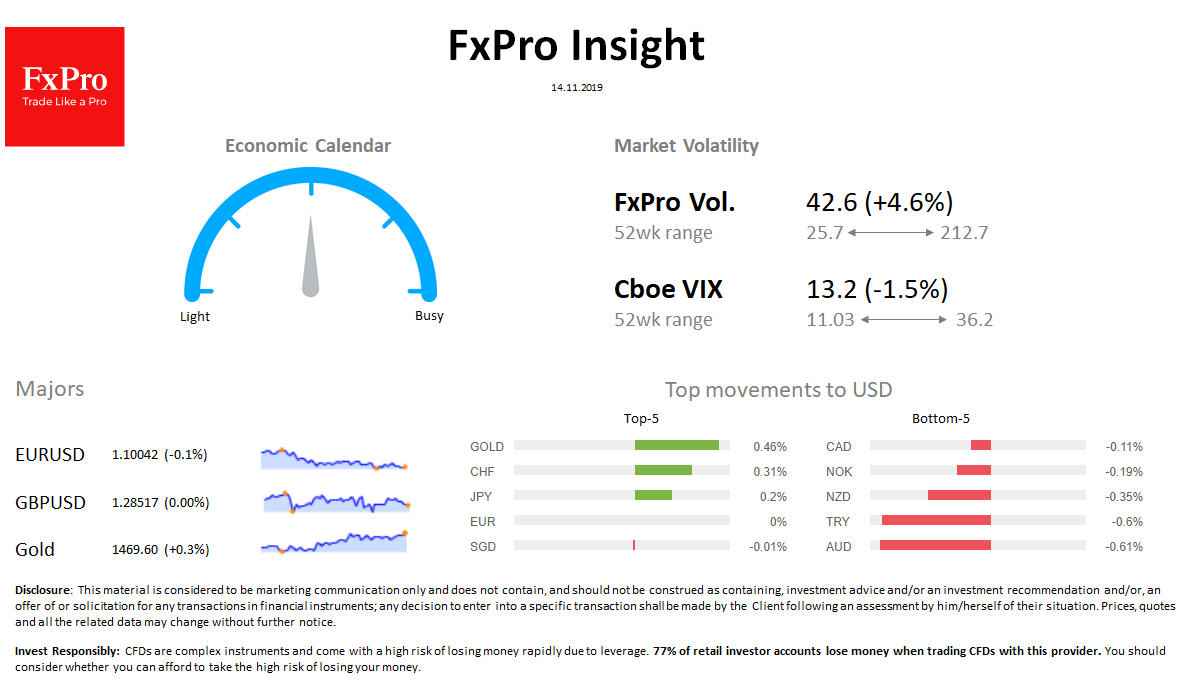

FX: The dollar index maintains its positions near monthly highs. AUDUSD lost 0.5% after weak employment data. EURUSD rebounds for the second day in a row after attempts to lower under 1.1000. GBPUSD remains at 1.2850, gaining 20 points, despite weaker retail sales.

Stocks: Futures for S&P500 remains near the all-time highs at 3089. MSCI World unchanged to levels 24h ago. The VIX volatility index fell from 13.44 to 13.2.

Commodities: Brent traded at $ 62.2, adding losing $ 1.4 per day. Gold increased to $1469, developing a rebound after brief touch $ 1450.

Crypto: Bitcoin is slowly losing ground, dropped to $ 8600. The top-10 altcoins range from -3.5% (BCH) to + 1.5% (XMR).

Important upcoming events (GMT):

13:30 USD [!!] US Producer Price Index 15:00 USD [!!!] Fed Chairman Powell Speaks 16:00 WTI [!!] US Crude Oil Inventories