Market overview

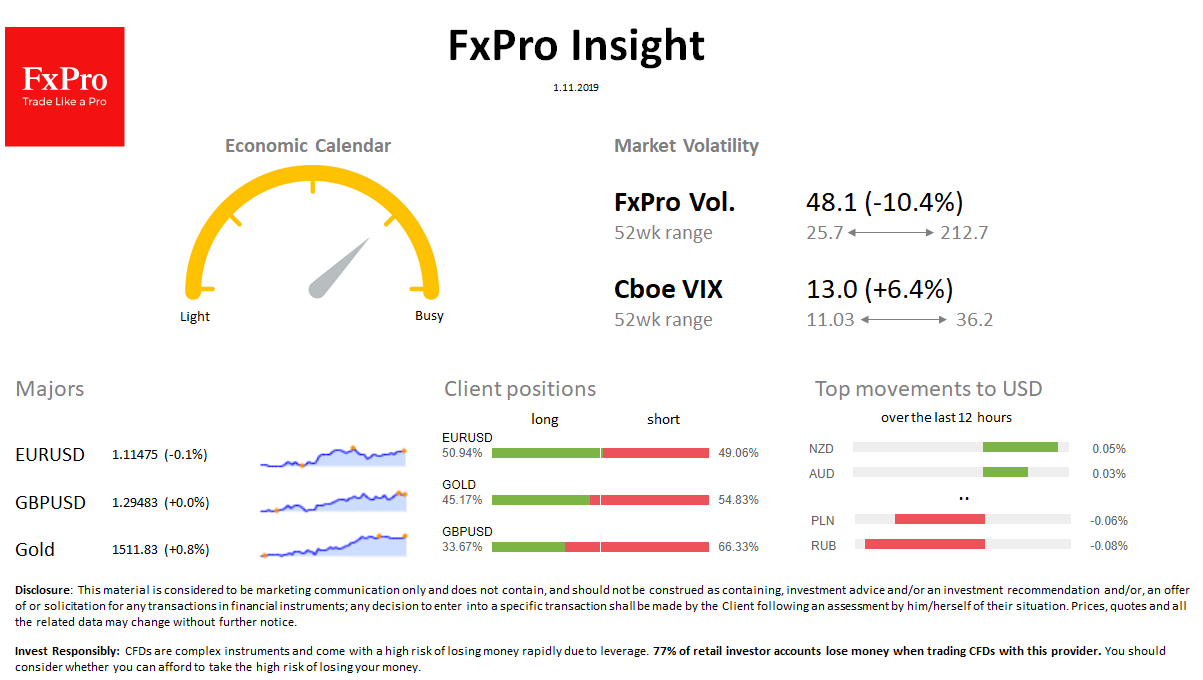

FX: The dollar remains under pressure, declined another 0.1% at DXY. GBPUSD added 0.5% this morning, EURUSD virtually unchanged to Thursday’s close near 1.1150. Often, ahead of Payrolls report, market volatility drops noticeably, just to taking off immediately after it.

Stocks: Futures for S&P500 retreated 0.1% over last 24h 3042. MSCI World at the same levels as the day before. The VIX volatility index grew from 12.2 to 13.0.

Commodities: Brent lost $ 1.1 to $59.5. Gold jumped to $1512.

Crypto: Bitcoin maintaining its positions at $ 9100. The top-10 altcoins ranged from -2.3% (BSV) to + 8.2% (XLM).

Important upcoming events (GMT): 12:30 USD [!!!] US Employment report 14:00 USD [!!] Manufacturing ISM 17:00, 18:30 USD [!!] FOMC Members Clarida, Quarles, Williams Speak