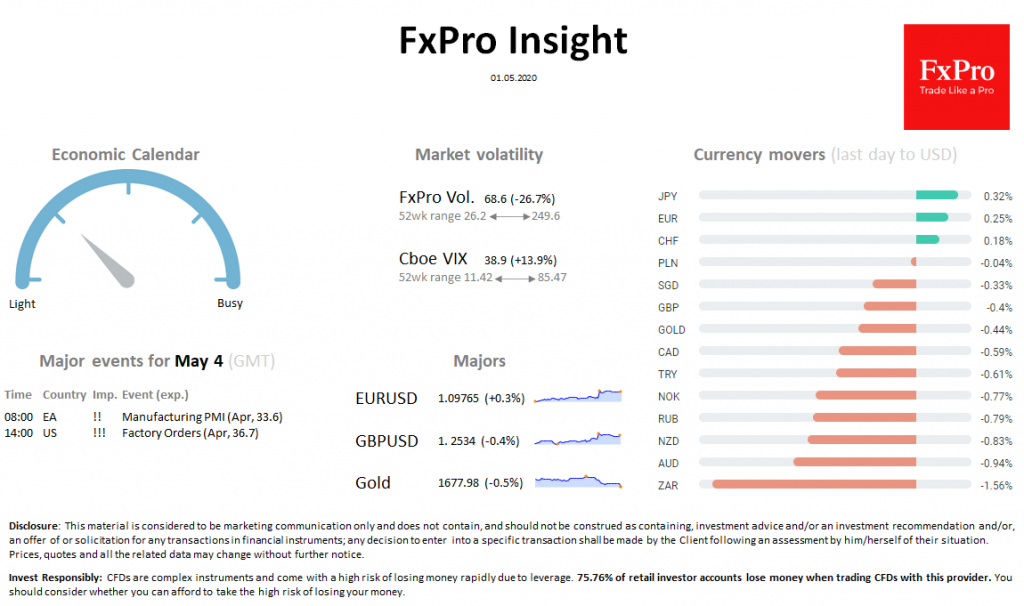

Futures on the SP500 lose 1.3% before the start of the New York trading session after falling 2.5% a day earlier. VIX has grown markedly, reflecting risk aversion in markets. DAX, CAC40 lose 2.1% each, FTSE100 drops 1.9%.

DXY yesterday nevertheless returned to decline, losing the sixth trading session in a row. In the FX market is a visible retreat from risk as to the decline in the dollar index today due to a fall to the euro, franc, yen. EURUSD earlier today reached 1.0990 (+1.5% after the ECB).

Gold did not escape the trend of risk avoidance, declined to $1678. Fixing positions at the end of the month puts pressure on quotes.

On WTI intraday charts, methodical purchases are stored for the fourth day in a row. Brent in the spot market is trading at $ 27.4, adding, despite the risk aversion in other sectors.

Investors have to understand, whether current decline profit-taking or the end of the rebound, followed by a long decline.

Important events for May 4, GMT (Exp.): 08:00 EA !! Manufacturing PMI (Apr, 33.6) 14:00 US !!! Factory Orders (Mar)