Market overview

US markets have added 1.4% since the start of trading on Monday, after falling 3.4% on Friday. Markets balance between news of a slowdown in new infections (positive) and the prospect of more extended quarantine (negative).

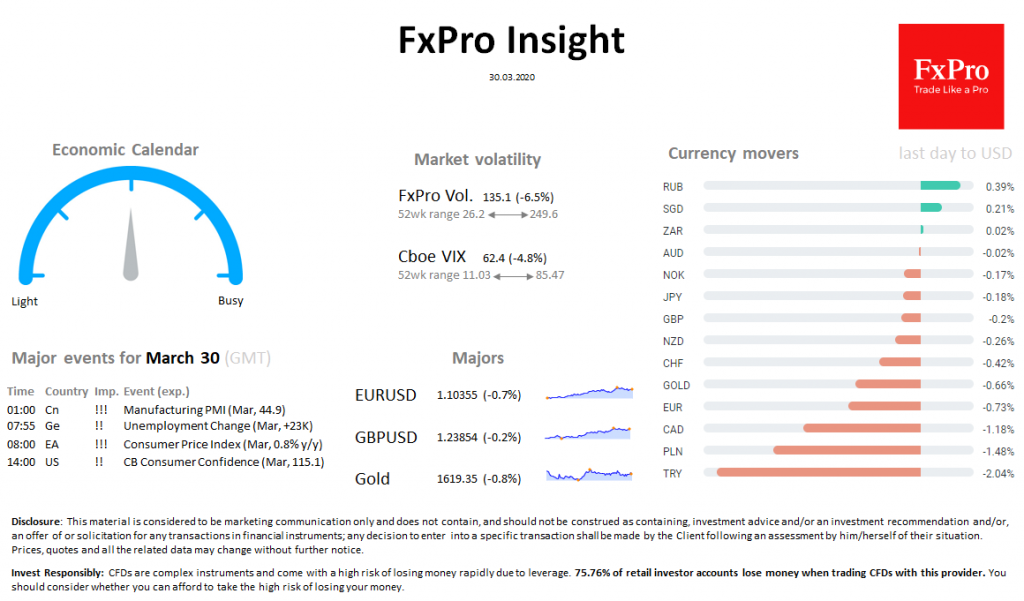

DXY added after six sessions decline on traditional dollar demand increase at the quarter-end. EURUSD returned to 1.1030. GBPUSD remains at 1.24. The currencies of countries with acceleration in the cases growth rate as the market anticipates the tighter restrictions.

Gold is still having difficulty rising above $ 1,630.

Brent fell below $ 26, WTI at 21.70, losing more than 5% in the spot contracts. The nearest oil futures are at the lowest since 2002. Futures with later valuation dates marks a sharp rebound in prices.

The global tipping point with the spread of coronavirus has not yet arrived, maintaining a shaky foundation under market recovery.

Important events, GMT (Exp.):

01:00 Cn !!! Manufacturing PMI (Mar, 44.9) 07:55 Ge !! Unemployment Change (Mar, +23K) 08:00 EA !!! Consumer Price Index (Mar, 0.8% y/y) 14:00 US !! CB Consumer Confidence (Mar, 115.1)