Market overview

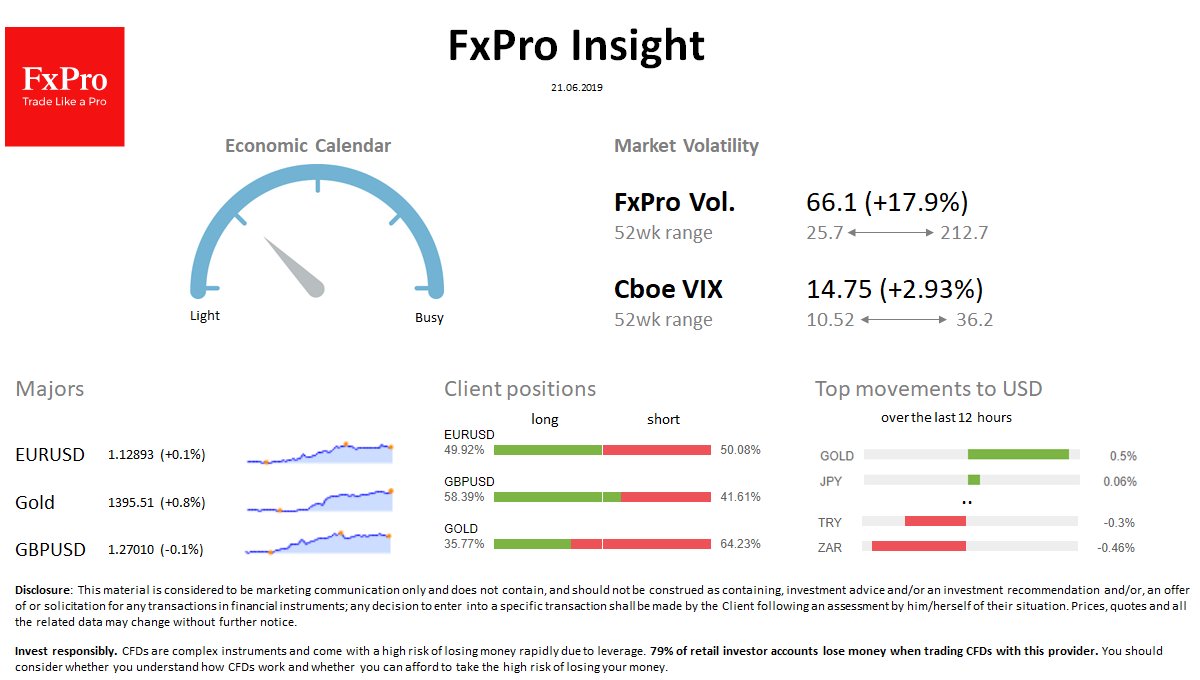

FX: the USD on Friday morning to have stabilized after declining 1% on Thursday. High-yielding currencies took correction after the rally during the week.

Stocks: SPX, Nikkei225, Euro50 start Friday with a retreat after growth the day before.

Commodities: Brent adds more than 3% over the last 24h due to tensions between Iran and the U.S. Gold this morning rose above 1410, and on the way to end the week with the sharpest growth in 3 years.

Crypto: Bitcoin rewrote its 13-month highs above $9700, potentially targeting $10000.

Important events and speeches (GMT): 07:30 De [!!] Preliminary PMI 08:00 EU [!!] Preliminary PMI 13:45 US [!!] Preliminary PMI 17:00 Oil [!] U.S. Rig Count