Market overview

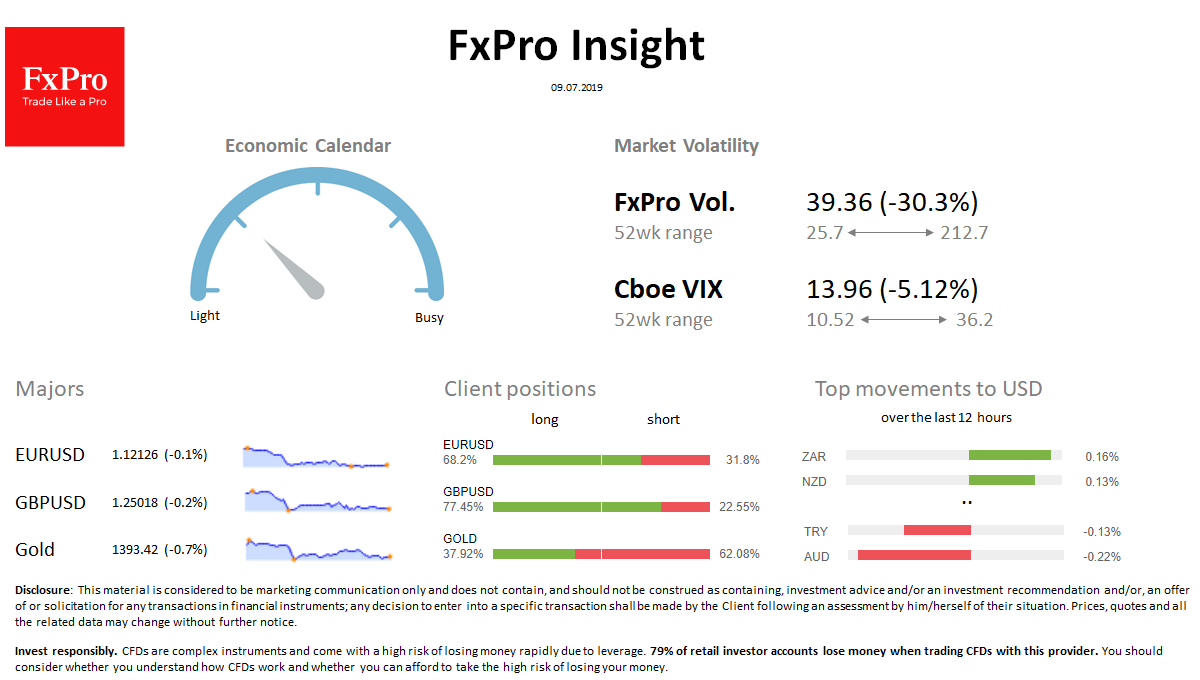

FX: USD craved upward, but the pace of growth slowed down recently. Market volatility has generally decreased in anticipation of new signals from the Fed.

Stocks: Indices are losing ground on the reassessment of the Fed policy expectations and rolling back from recent peaks.

Commodities: Brent retreated after failed attempt to climb above 65 on Monday, dropping to $63.70 at the time of writing. Gold adjusted 5th trading session in a row trading at $1393.

Crypto: A new growth spurt brought Bitcoin back to the 18-month highs at $12700.

Important upcoming events (GMT):

12:45 US [!!!] The speech of the Fed’s Powell 14:10-18:00 US [!!] Speeches by FOMC members Bullard, Quarles, Bostic