Market overview

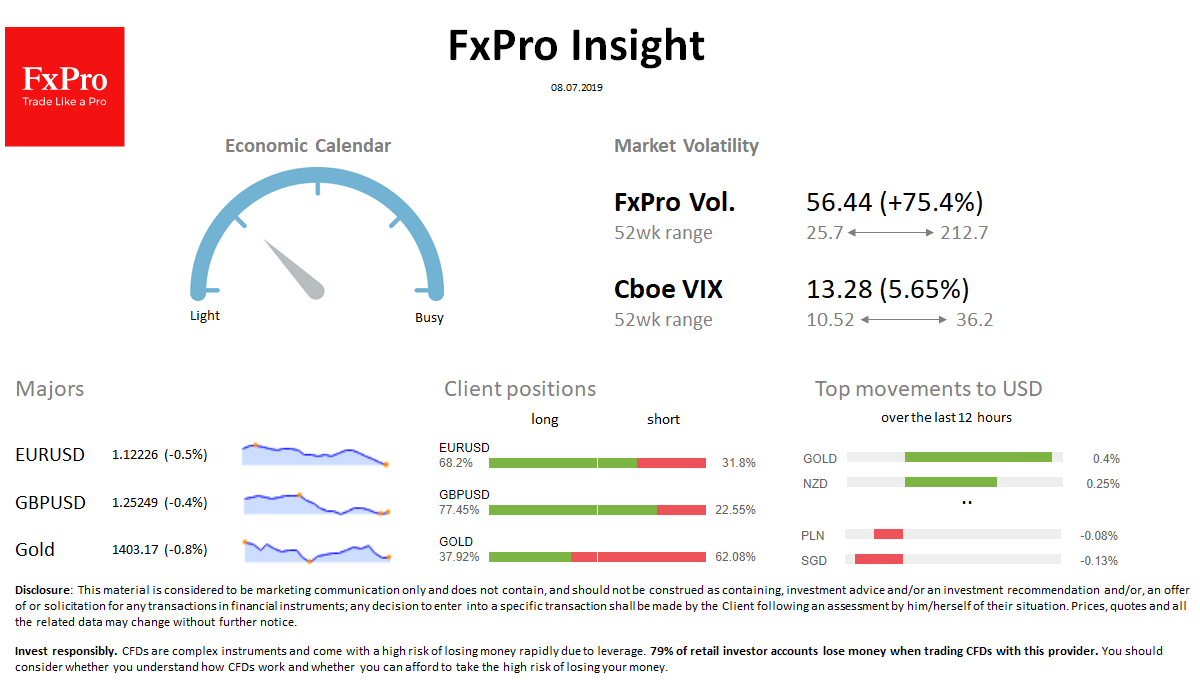

FX: USD gained more than 0.5% after a strong NFP. Purchases are supported by a decrease in the chances of an aggressive Fed rate cut. TRY loses 2.5% this morning after an unexpected change of Central Bank Governor.

Stocks: SPX rolling back from highs, following reassessments of expectations on monetary policy.

Commodities: Brent is back above $64, balancing the growth of the dollar and strong data on the labour market. Gold returned above $1400 after a 2% dip after NFP.

Crypto: BTC adds 2% over the last 24h, trading close to $11500.

Important upcoming events (GMT):

EU [!!] Eurogroup Meeting