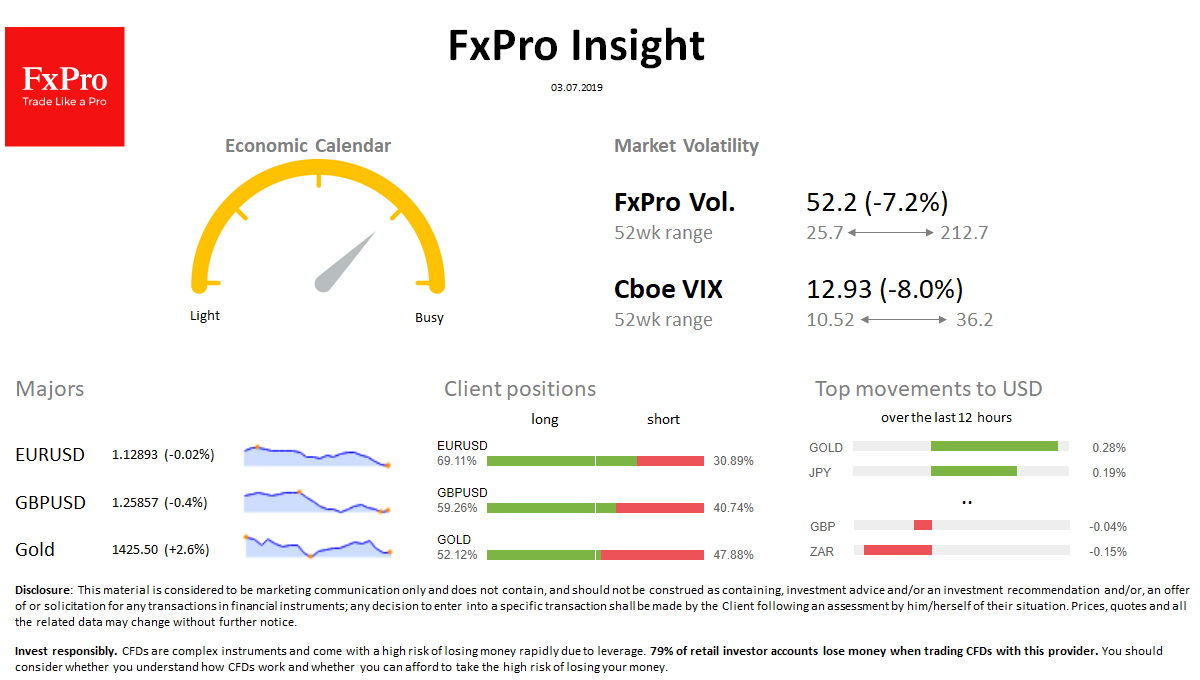

Market overview FX: GBP loses 0.4% on BoE’s fears around the effects of trade wars; JPY and CHF rose due to demand for safety bonds. Stocks: SPX plies near the highs in anticipation of further signals. ChinaA50 retreats from two-month highs. Commodities: Brent loses 3.5% despite OPEC+ support current quotas until March 2020. Gold back to the highs, jumping by 2.6%. Crypto: the Crypto Market turned to growth after a deep correction. Bitcoin rose by 16% over last 24h to $11400.

Important upcoming events (GMT): 08:00 EU [!!] Services PMI 08:30 UK [!!] Services PMI 12:15 US [!!!] ADP Employment report 14:00 US [!!!] Non-manufacturing ISM