Market overview

FX: GBP updates 27-month lows on fears of no trade deal Brexit. USD is growing following strong data on the U.S. economy.

Stocks: U.S. Indices turned to decline in the desire of players to fix part of the profits from the previous growth. Asian markets are trading almost unchanged.

Commodities: Brent thread waters just above $64.0 after the decline by 4.8% on Tuesday. Gold try holds above $1400 level.

Crypto: Bitcoin sank under $10000, the whole cryptocurrency market is declining due to pressure from U.S. congressmen for Facebook’s Libra project.

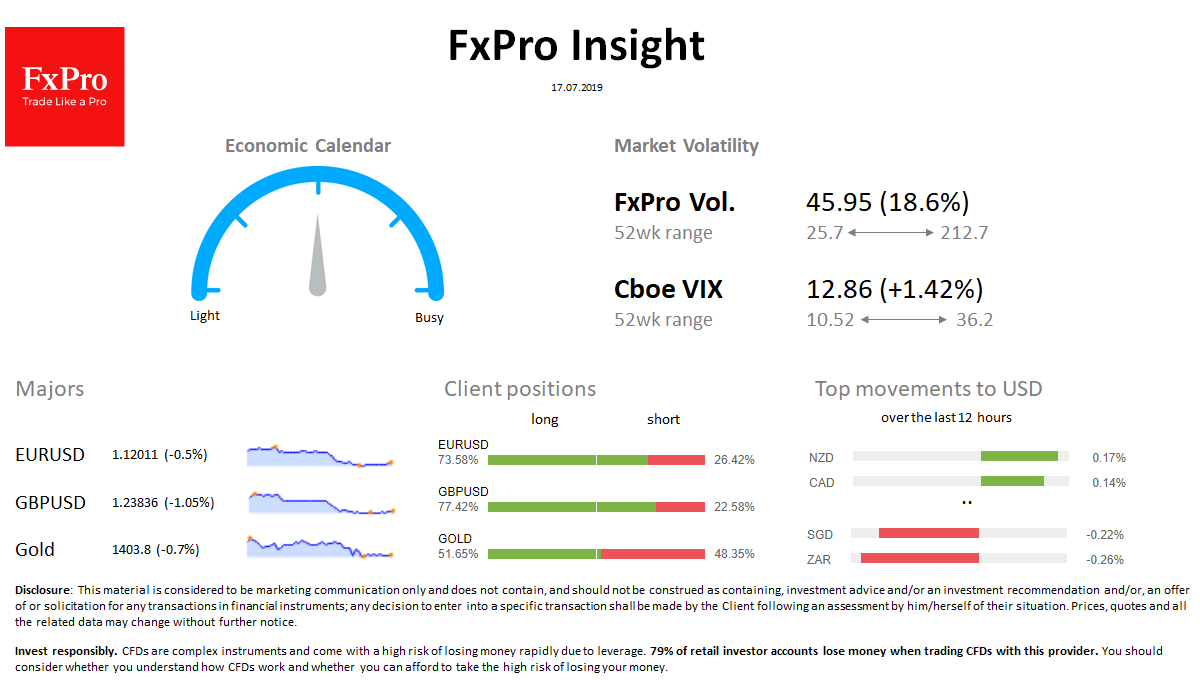

Important upcoming events (GMT): 08:30 UK [!!!] Consumer Price Index 09:00 EU [!!] Consumer Price Index 12:30 CA [!!!] Consumer Price Index 12:30 US [!!!] Building Permits