Market overview

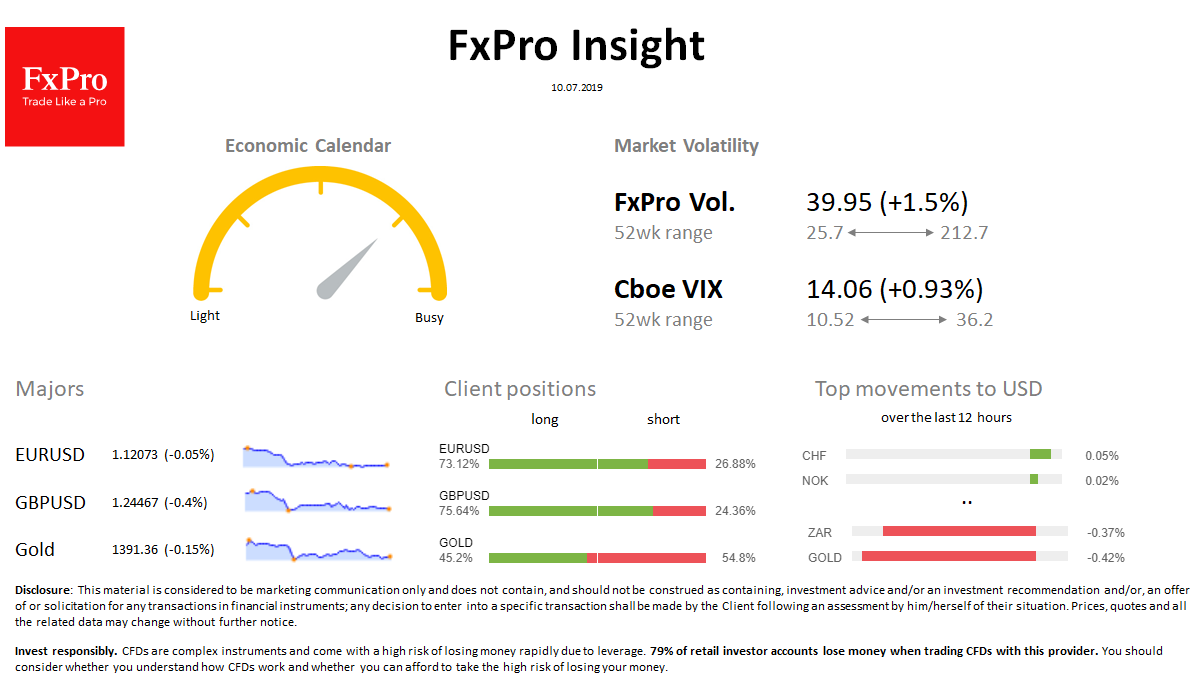

FX: USD recaptures its positions in anticipation of Powell’s speech. GBP remains below 1.25, falling to 2-year lows yesterday.

Stocks: The pressure on the stock indices went back during the Asia trading session. SPX returned to Tuesday’s opening levels, HengSeng at 2-week lows.

Commodities: Brent has grown to $64.70 after reports on the decline in the U.S. inventories. Gold at $1390, returning to a corrective decline.

Crypto: Bitcoin has gone up to $13000, but altcoins have ignored the latest wave of growth.

Important upcoming events (GMT):

08:30 UK [!!!] Monthly GDP 14:00 CA [!!!] Bank of Canada rate decision 14:00 US [!!!] Powell’s report to Congress 18:00 US [!!!] FOMC meeting minutes