Monday was one of the quietest days for the foreign exchange market over the past few years, not least due to the US holidays. In the middle of the trading day in Europe, EURUSD stay near 1.1100, GBPUSD gained support on robust UK unemployment data. Stock markets are under pressure due to fears of the spread of Chinese coronavirus: European and Asian indices are falling within 1%. Dow Jones futures are losing about 0.4%. Oil has lost about 1.5% since the start of the day on the renewed concern around global consumption. Gold fell 0.9% due to worries about demand for it in China.

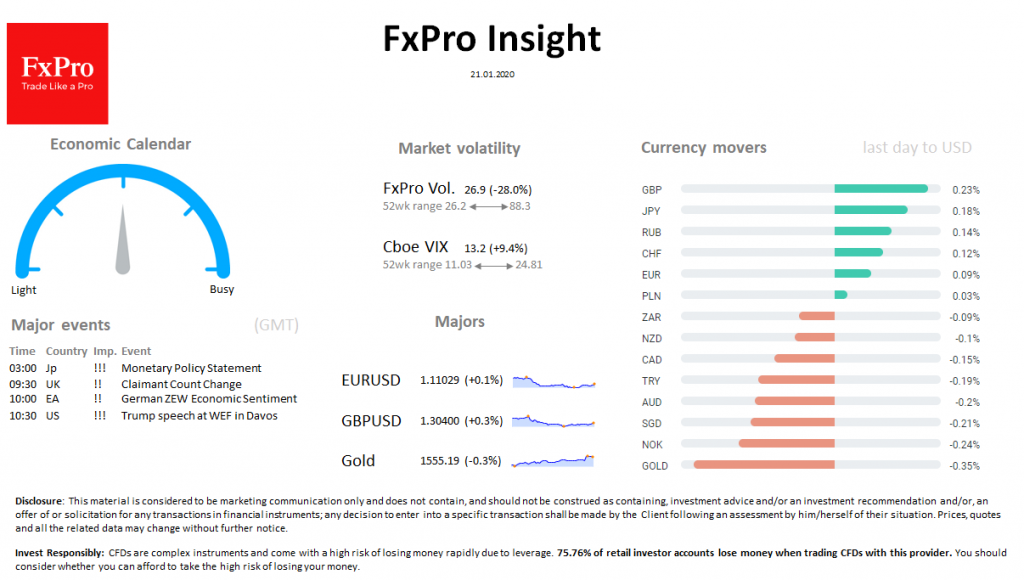

Important events (GMT): 03:00 Jp !!! Monetary Policy Statement 09:30 UK !! Claimant Count Change 10:00 EA !! German ZEW Economic Sentiment 10:30 US !!! Trump speech at WEF in Davos