Market overview

Stock markets are boosting amid robust US macro data and positive news about the spread of coronavirus. Brent crude turned down the last hours after a rebound on Wednesday. Gold rose to $ 1563, gaining support after the drop below $1550. RUB and ZAR are in a correction on Thursday afternoon after an impressive growth earlier this week. EURUSD suspended the decline at 1.1000. GBPUSD slid below 1.3000. USDCAD rally from 1.300 to 1.3200 over the past three weeks has caused the FxPro traders to divide 4.15% to 95.85% in favour of Sell. For AUDUSD, we see the mirrored situation, despite the growth of the pair this week.

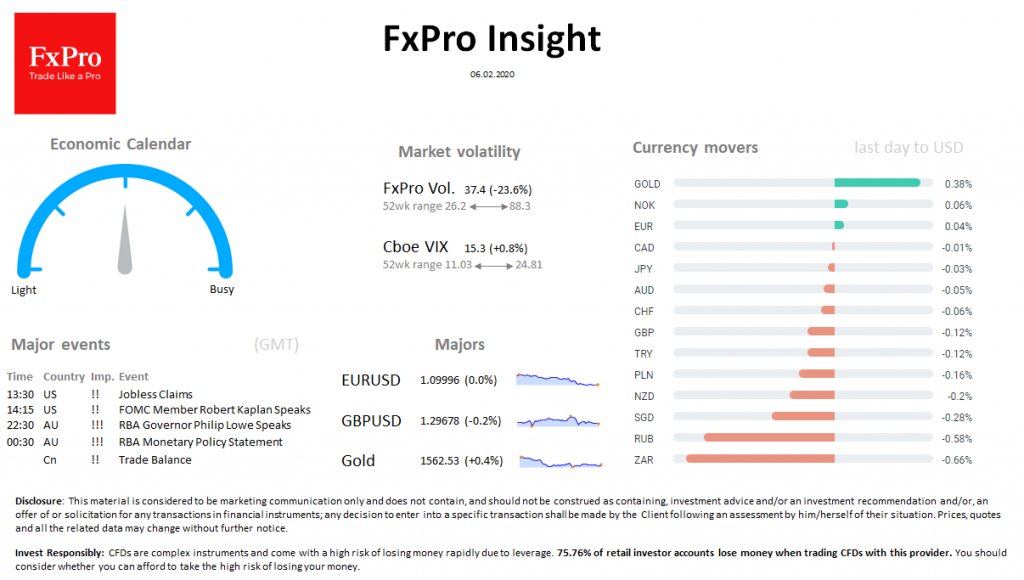

Important events (GMT): 13:30 US !! Jobless Claims 14:15 US !! FOMC Member Robert Kaplan Speaks 22:30 AU !!! RBA Governor Philip Lowe Speaks 00:30 AU !!! RBA Monetary Policy Statement Cn !! Trade Balance