Market overview

S&P500 updates historic highs at the opening of trading on Tuesday, Nasdaq almost daily updates it’s since February 2. There is growing confidence in the markets that major central bank may quickly increase stimulus if needed.

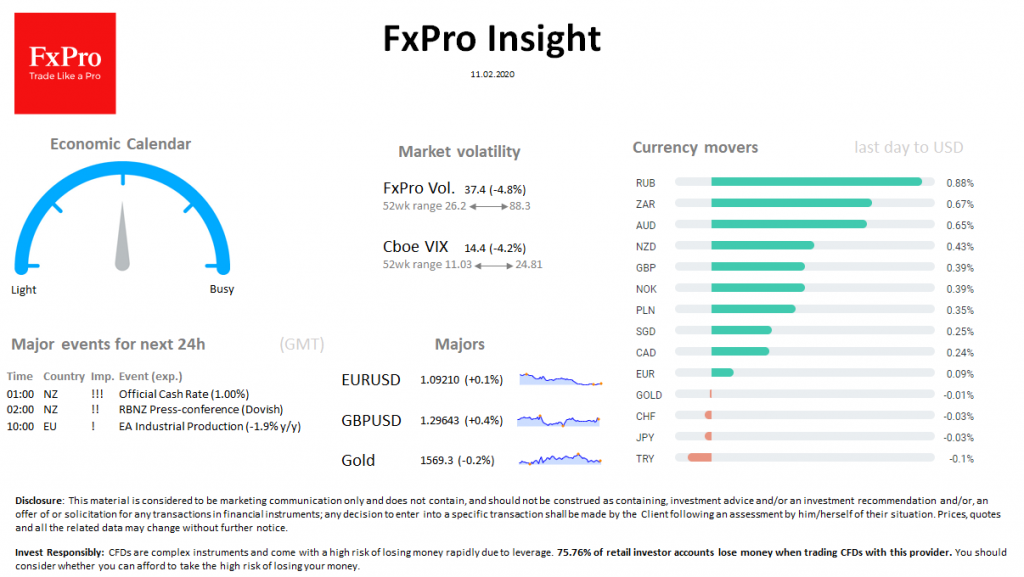

On FX, the dollar index retreated from the 4-month peaks, declining for the first time after seven sessions back-to-back growth. Risk-sensitive RUB, ZAR, AUD are leading thee growth to USD.

Gold maintains its growth trend for the second week, adding as protection against potential inflation, not as a safe-heaven. WTI Oil is attempting to return to the area above $50, after touching 13-month lows. Brent has added 2.4% to Monday’s lows before the US session open.

Important events (GMT): 01:00 NZ !!! Official Cash Rate (1.00%) 02:00 NZ !! RBNZ Press-conference (Dovish) 10:00 EU ! EA Industrial Production (-1.9% y/y)