Market overview

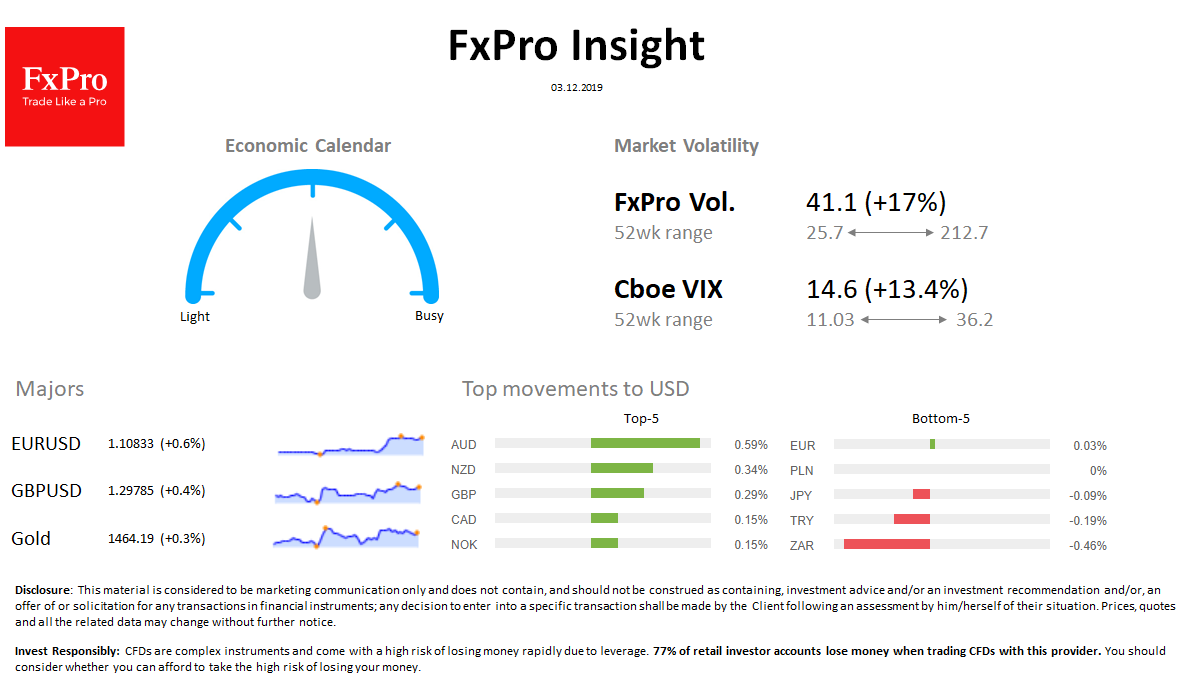

Forex: The decline in the dollar accelerated after a new round of pressure on the Fed by Trump and weak US production data. DXY for the day fell by 0.5% to 97.7. EURUSD on Monday received a healthy boost to growth after touching 1.1000, trading at 1.1080 now. GBPUSD has returned to the 7-month highs area to 1.2980. AUDUSD gained 1.4% so far this week as metal tariffs for Argentina and Brazil are on hand for Australian mining companies.

Stocks: Futures for S&P500 are slightly up after the index fell 0.9% on Monday. A slight rebound after decline also observed in EuroStoxx 50 (+ 0.25%) after the 2.2% collapse. MSCI World lost 0.9% over last 24h. The VIX volatility index jumped from 12.9 to 14.63.

Commodities: Brent stabilized near $ 61.00, failing to develop growth. Gold rose to $ 1,466 following rising market volatility.

Crypto: Bitcoin traded near $7200 on Tuesday morning, returned to decline after an unsuccessful growth attempt. The top-10 altcoins range from -3.4% (BSV) to -1.0% (XRP).

Important upcoming events (GMT):

00:30 AUD [***] Au Gross Domestic Product 01:45 CNH [**] Cn Markit Services PMI