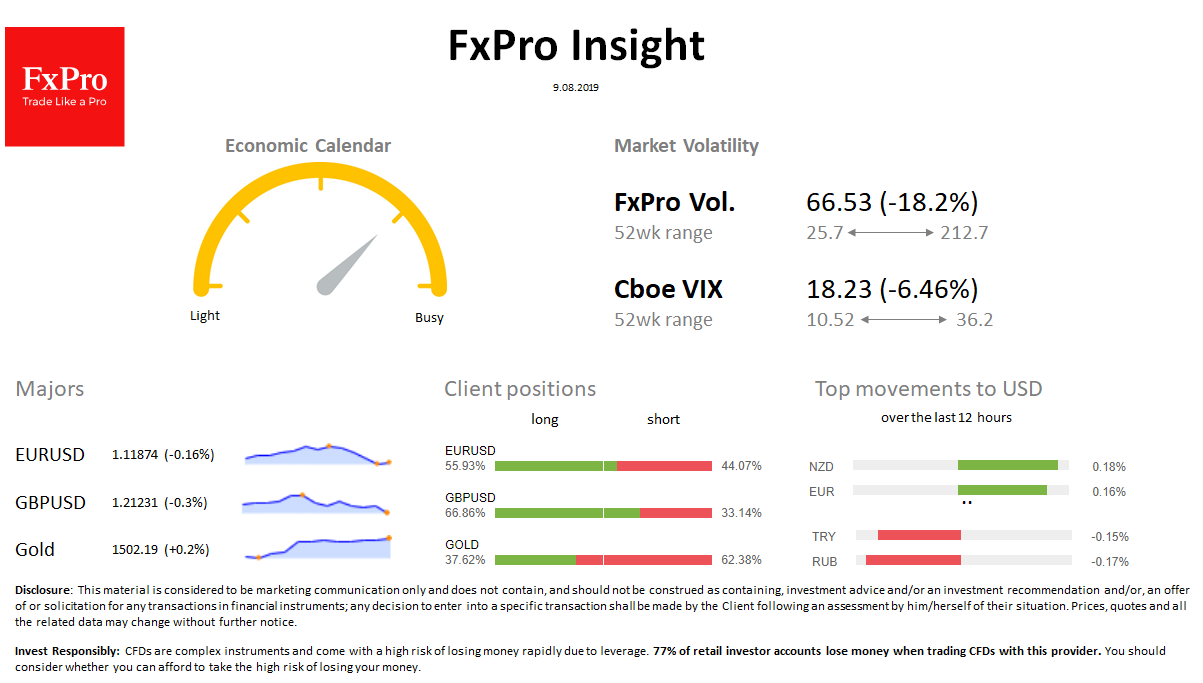

Market brief FX: The foreign exchange market has quieted down anticipating further signals. USDX lost 0.1% on Friday morning. JPY is growing, but NZD, AUD, EUR add too. At the other end of the spectrum are RUB, TRY, ZAR – lose 0.2% to USD.

Stocks: Markets suspended recovery after a new round of escalating trade tensions in the US and China. Chinese indices are losing 0.5-0.7%, SPX are down 0.4%.

Commodities: Brent fluctuations settled after the collapse on Wednesday, this morning oil lost 0.5% to $ 57.25. Gold closed shy above $ 1,500 on Wednesday and Thursday but reluctant to update recent highs at $ 1,510.

Important Upcoming Events (GMT): 08:30 GBP [!!!] UK GDP Preliminary estimate 12:30 CAD [!!!] Canada Employment 12:30 USD [!!!] US Producer Price Index 17:00 Brent [!! ] Baker Hughes U.S. Rig Count