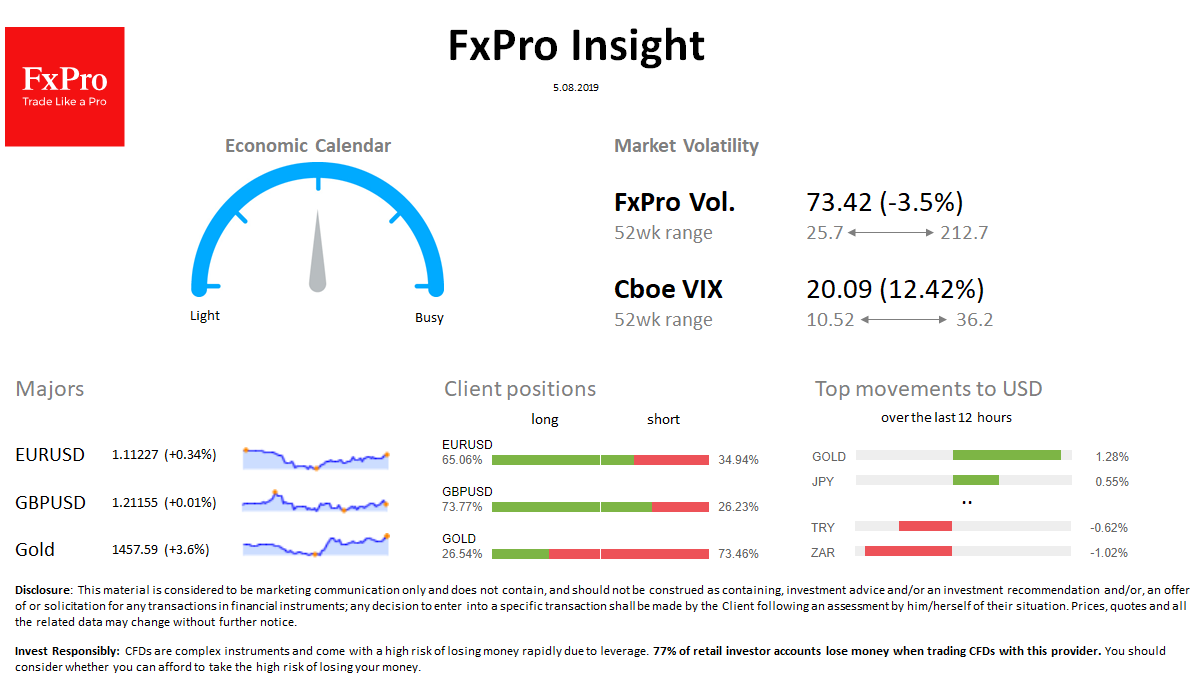

FX: Markets fear that currencies become a weapon in trading disputes. The flight from “yielding” to “safe” makes JPY, CHF – the best in performance this month. USDCNH jumped 2% to 7.11. GBPUSD rebounded again after a rebound.

Stocks: Markets fall sharply, losing about 2% on major indices at the start of Monday trading. This morning SPX fell by 1.3% below 2900, HengSeng dropped by 2%, losing more than 10% in 2 weeks.

Commodities: Gold rewrite 6-years highs, rising to $ 1,457. Brent so far avoided the sharp move, losing just 0.6% today to $ 60.80

Crypto: Bitcoin boosted growth above $11,500, supported by sell-off in Chinese markets.

Important upcoming events (GMT):

08:00 EU [ !!] Services PMI 08:30 UK [ !!] Services PMI 13:45 US [ !!] Services PMI 14:00 US [!!!] Non-manufacturing ISM