Market overview

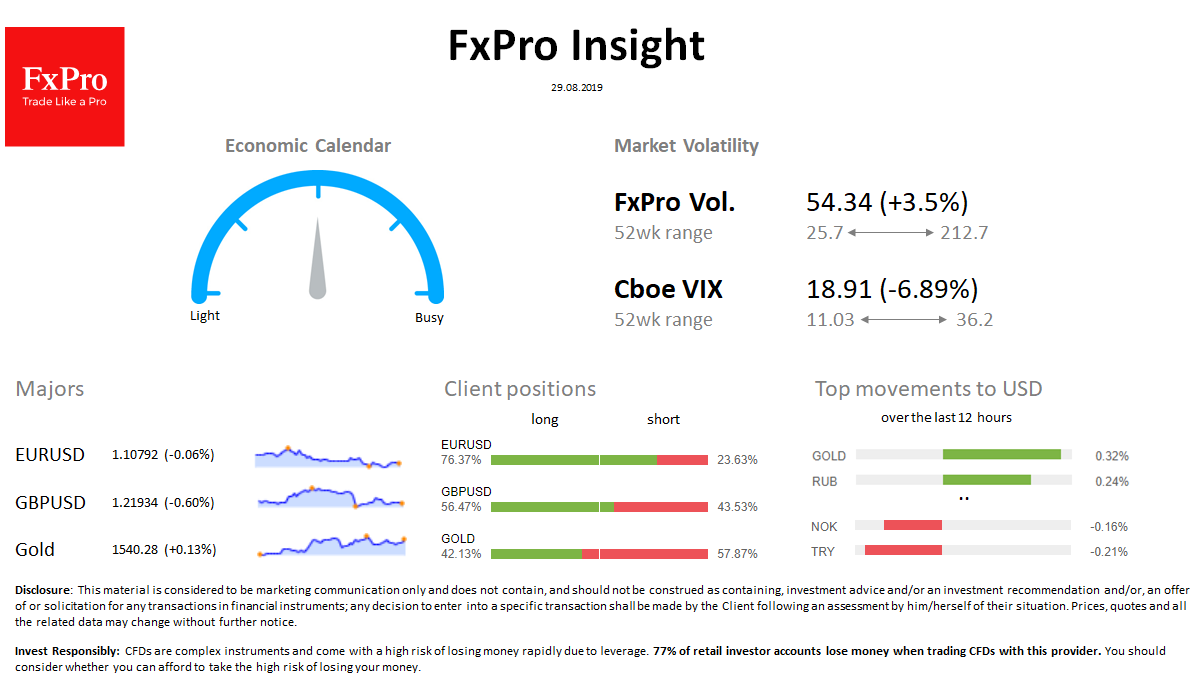

FX: Except for GBP pairs, the FX volatility reduced. The dollar index is adding less than 0.1% to 98.17 after strengthening 0.2% on Wednesday. EURUSD fell to 1.1075, a 27-month lows area. GBPUSD slid below 1.2200 due to lengthy parliamentary vacations ahead of Brexit.

Stocks: S&P 500 futures jumped 0.8% in recent minutes after gaining 0.5% the day before. MSCI Asia Pacific is adding 0.13% in the morning. The VIX volatility index fell from 20.3 to 18.9.

Commodities: Brent stood at $59.80 after rising 0.7% on Wednesday. Gold rolled back to $1540 after another failure to climb above $1550.

Crypto: Bitcoin failed at the end of the day on Wednesday with $10,200 and is trading at $9,400. The top-10 altcoins losing from 5% to 12% in the last 24 hours.

Important upcoming events (GMT):

12:00 EUR [!!] Germany Consumer Price Index 12:30 USD [!!] U.S. Gross Domestic Product 12:30 USD [!!!] U.S. Goods Trade Balance