Market overview

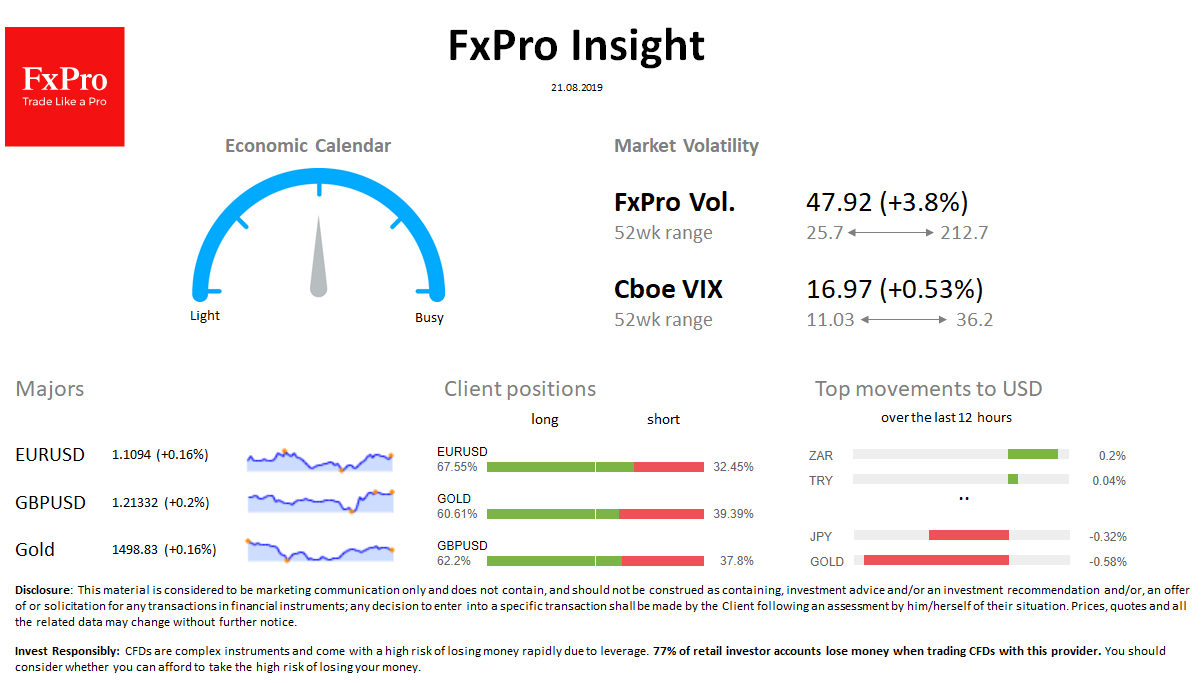

FX: The dollar index is adding 0.1% in the morning on Wednesday after falling 0.2% the day before. EUR and GBP are gaining ground, moving away from local lows. Turkish Lira (TRY) lost 2.7% in two days. The South African rand, by contrast, is strengthening after a drop since the beginning of the month. On the whole, a positive-neutral attitude prevails in the markets.

Stocks: S&P 500 futures added about 0.8% in the morning, having won back the decline a day earlier. The MSCI of the Asia-Pacific region has been trampled at about the same level since the beginning of the week. Stock market volatility declined after a spike earlier this month.

Commodities: Brent rose to $ 60, on API reports of US stocks dropping. Gold continues to run near 1500.

Crypto: Bitcoin loses 5% in 24 hours. Top 10 altcoins lose from 2.5% to 7%.

Important upcoming events (GMT):

12:30 CAD [!!!] Canada Consumer Price Index 14:00 USD [ !!] U.S. Existing Home Sales 17:00 USD [!!!] FOMC Meeting Minutes