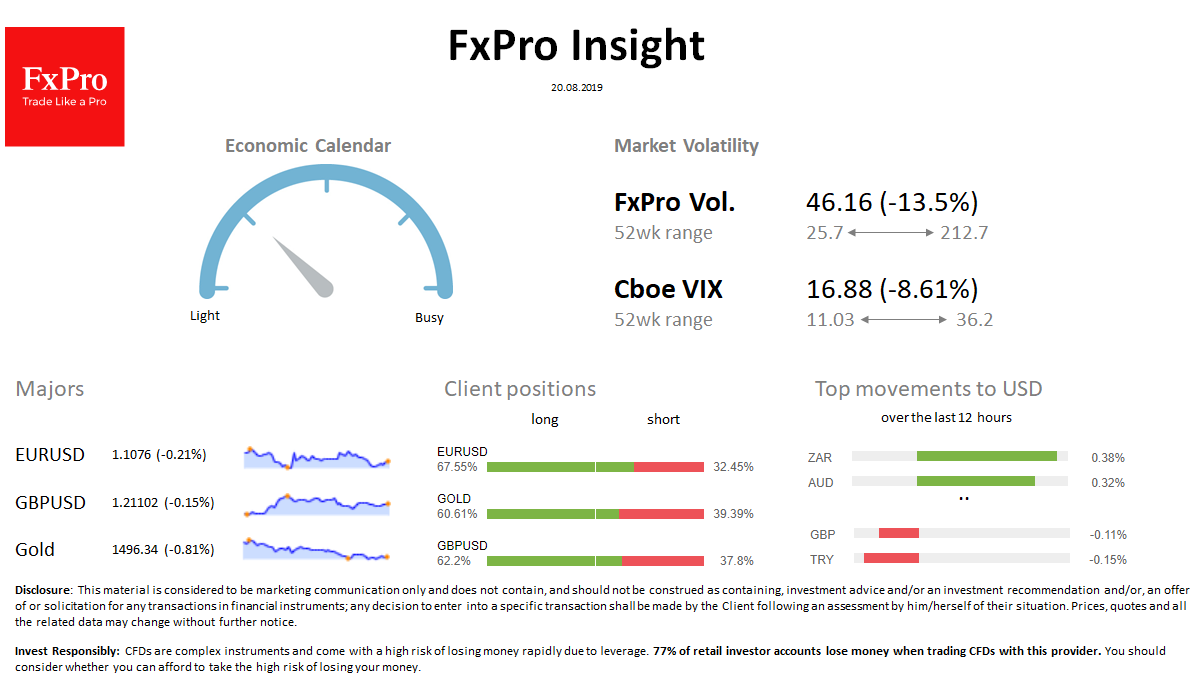

Market overview FX: The dollar index is growing for the 6th consecutive trading session, returning to this month highs. There is no clear risk on/off sentiment in the foreign exchange market, as both risk-sensitive AUD, RUB, ZAR and protective CHF, JPY adds 0.2% to USD.

Stocks: S&P 500 gains about 0.4% this morning after rising 1.2% the day before. The Asia-Pacific MSCI grew 0.3% on stimulus hopes and decreased fears of a recession.

Commodities: Brent is trading at $ 59.20, adding 0.5% over the past day. Gold retreated below 1500.

Crypto: Bitcoin adds 2% in 24 hours. Top 10 altcoins fluctuate between a decrease of 2.5% and an increase of 3%.

Important upcoming events (GMT):