Market overview

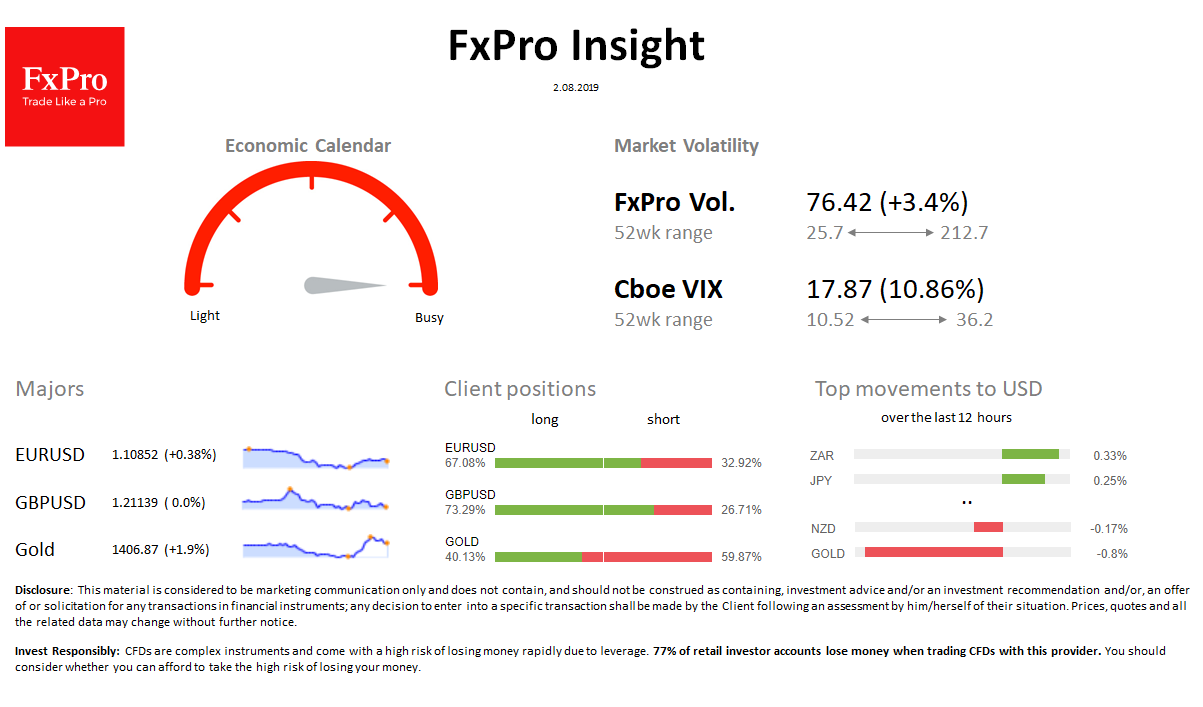

FX: USD retreated to the basket of major currencies, but remains close to a 2-year high. JPY strengthened by 2% over the last 24h. CNY once again is dangerously close to 7.00 after the announcement of the tariffs.

Stocks: Indices fell, as an escalation of trade conflicts has been added to the tough rhetoric of the Fed.

Commodities: Brent sank to $61.0, down by 4.2% on the news on tariffs. Gold loses 0.8% in the morning after a jump from $1400 to $1450, or 3.5% at the end of the day on Thursday.

Crypto: Bitcoin again attracts buyers, rising to $10,500. The main altcoins in the green zone.

Important upcoming events (GMT):

08:30 UK [ !!] Construction PMI 09:00 EU [ !!] Retail Sales 12:30 US [!!!] Non-farm employment 17:00 Crude Oil [ !!] Baker Hughes U.S. Rig Count