Market overview

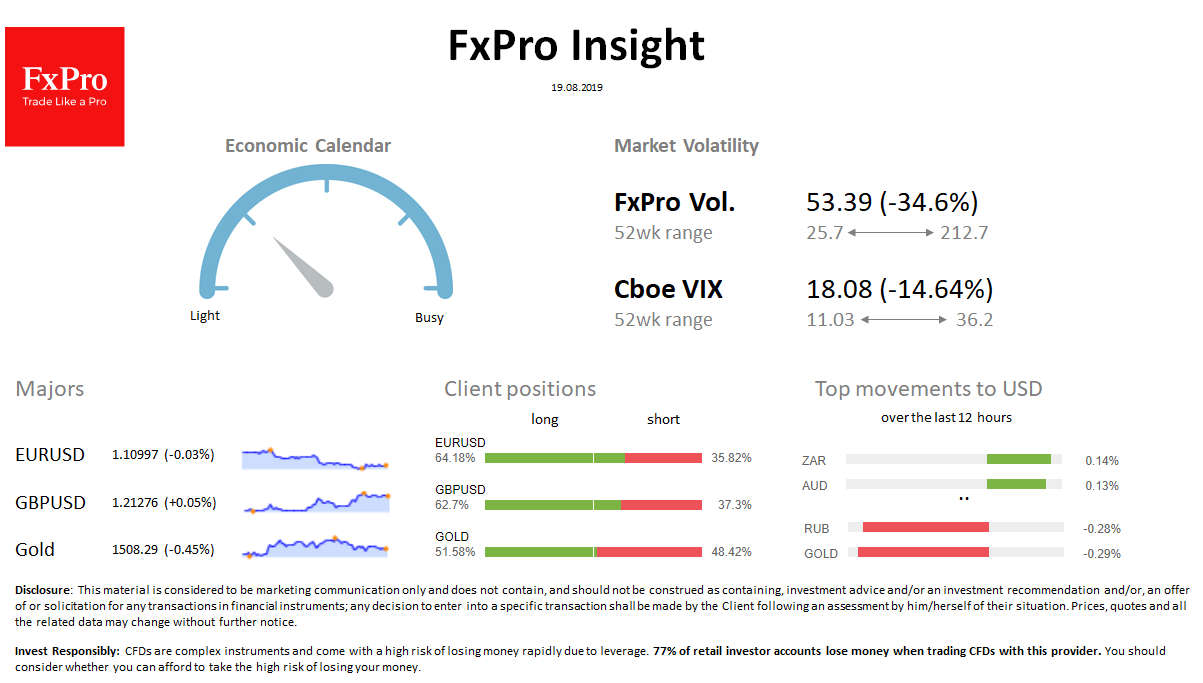

FX: Risk-sensitive currencies (ZAR, AUD, NZD) added in anticipation of China, Germany, the United States stimulus. The dollar index is losing 0.1%. Market volatility declined.

Stocks: Key indices in the green zone follow the Chinese markets, adding more than 1.5%. S& P500 futures added 0.8% in the morning after rising 1.4% on Friday. Market volatility declined.

Commodities: Brent grew 1.3% on Monday, again trying to break above $59. Gold lost 0.4%, declined the second trading session after the recovery in demand for risk assets.

Crypto: Bitcoin adds more than 5%, returning to $10700. Top-10 altcoins grow by 5% -8%.

Important upcoming events (GMT):

09:00 EUR [ !!] Euro area Consumer Price Index 01:30 AUD [!!!] RBA Monetary Policy Meeting Minutes