Market overview

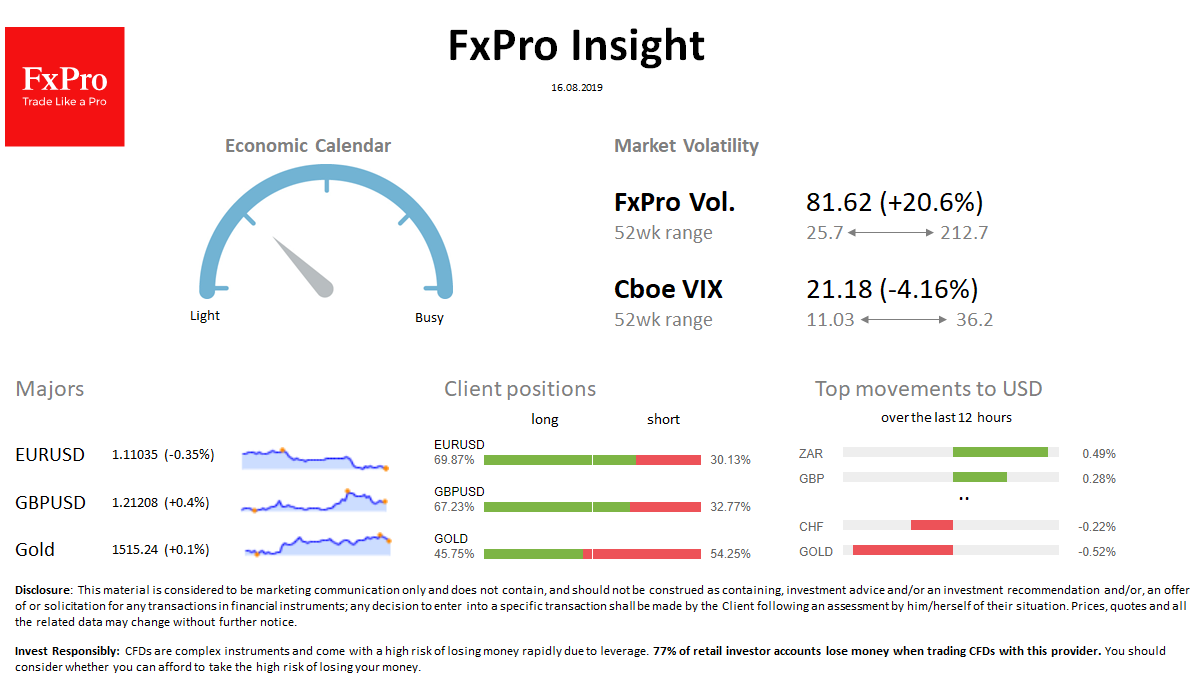

FX: Dollar index rises for 4-day high due to safe-haven demand. EURUSD fell under pressure on ECB’s hints to massive stimulus, that drags USDCHF higher. GBP and other risk-sensitivities increased, along with ZAR, AUD added 0.3% this morning. The volatility in pairs with JPY has increased significantly. Stocks: Futures for S&P500 are up 0.4% after rising 0.3% on Thursday. Chinese markets jumped 1.4% on stimulus news, but by the close of trading returned half the gain. The VIX index retreats after the mid-week jump. Commodities: Brent is added 1% to $58.60 on Friday morning, maintaining a positive trend in this month. Gold jumped to $1,527 in the morning but quickly retreated to $1,516. Crypto: Bitcoin ($ 9,850 now) has been losing 5% this morning, after an unsuccessful attempt to gain a foothold above 10,000 on Thursday. Top 10 altcoins do not lose so much.

Important upcoming events (GMT):

09:00 EUR [!] EA Trade Balance 12:30 USD [!!] US Building Permits 14:00 USD [!!] US UoM Consumer Sentiment 17:00 WTI [!!] Baker Hughes U.S. Rig Count