Market overview

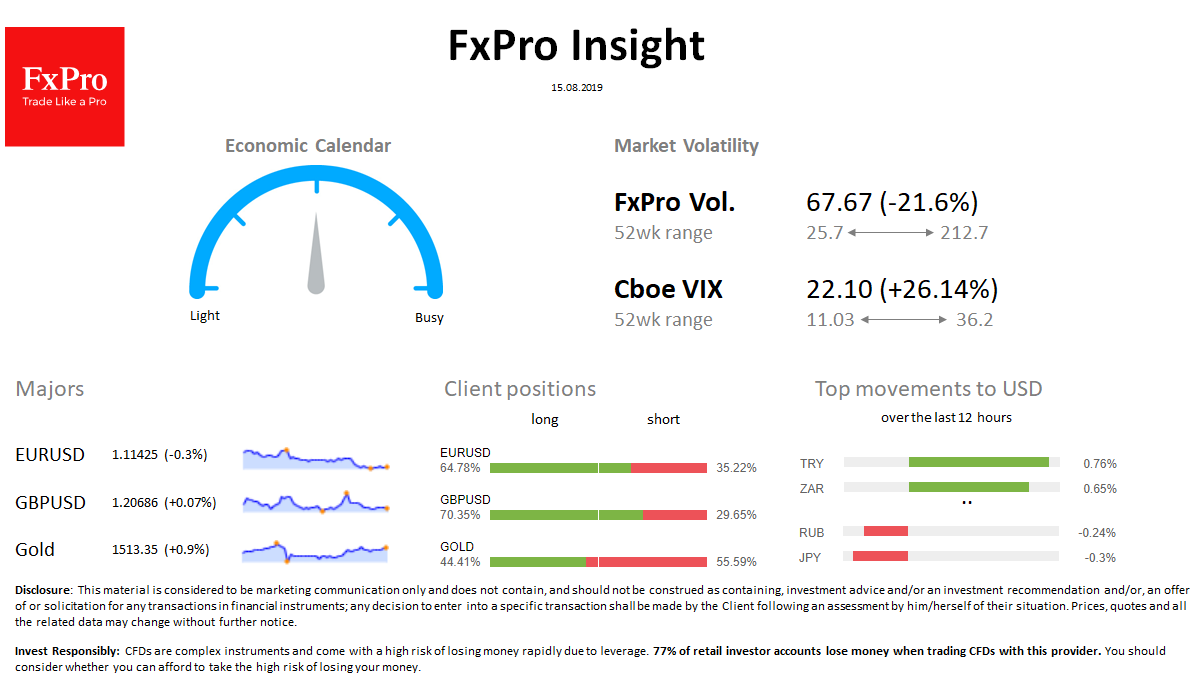

FX: The dollar index rose due to the demand for US protective government bonds. USDJPY, USDCHF again added on Thursday morning, Risk-sensitive TRY, ZAR, AUD add more than 0.6% this morning. Overall, volatility on FX has declined.

Stocks: S&P500 futures are shyly recovering after a 3% failure the day before. Chinese markets are adding 1.5%, trying to recover from the sale. The VIX index is at the highs of early August.

Commodities: Brent purchases intensified after the drop below $59. Gold treads at $ 1512, turning down after an unsuccessful attempt to overcome $ 1520.

Crypto: Bitcoin ($ 9,700 now), like the Top 10 altcoins, lost about 7% over the past 24 hours.

Important upcoming events (GMT):