Market overview

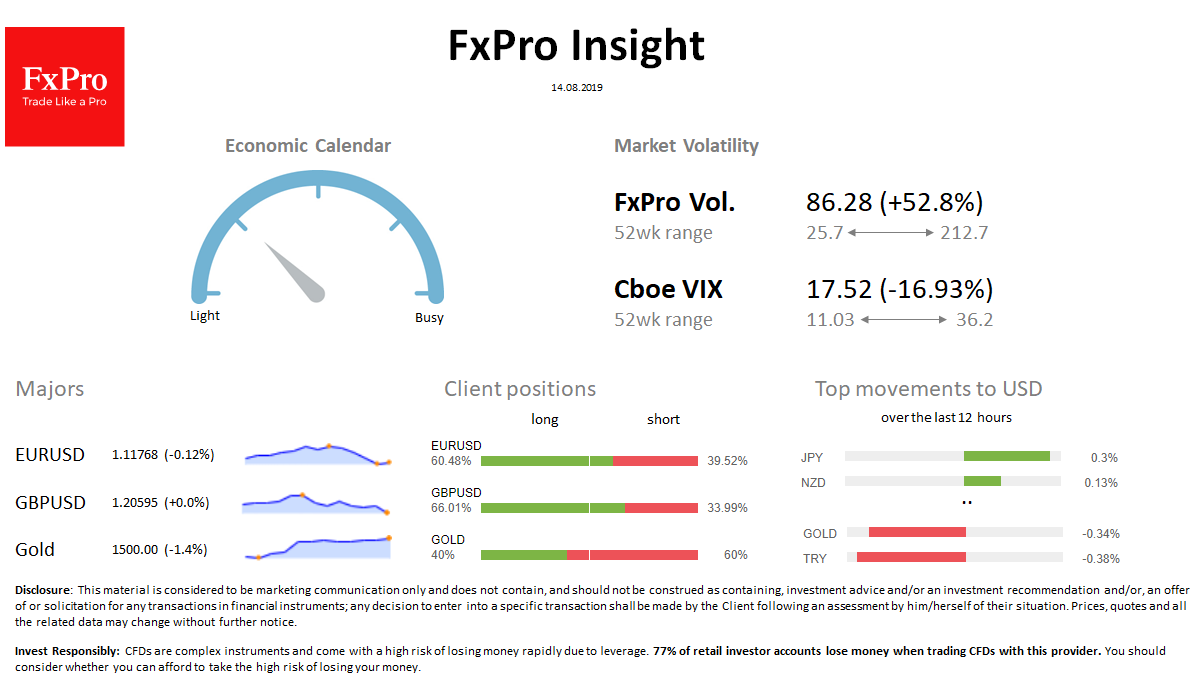

FX: The greenback rose after tariff delay to China import, as it reduced the chances of Fed rate cuts. USDJPY, USDCHF at the moment jumped 1.5% on the wave of withdrawal from safe assets, but already on Wednesday morning, protective currencies again added. The sharp movements of the foreign exchange market caused a jump in the volatility index.

Stocks: The S&P500 jumped nearly 2% within an hour after the announcement of the tariffs delay, but the momentum quickly ran out. Market growth has led to a decrease in volatility.

Commodities: Brent fell in the morning to $ 60.40 after jumping 5% to $ 61.20 last night. Gold retreated below levels below $ 1,500 after touching $ 1,535.

Crypto: Bitcoin dropped to $ 10,500; Top 10 altcoins lose up to 7%

Important upcoming events (GMT): 08:30 GBP [!!!] UK Consumer Price Index 09:00 EUR [ !!] Euro area Gross Domestic Product 14:30 WTI [ !!] US Crude Oil Inventories