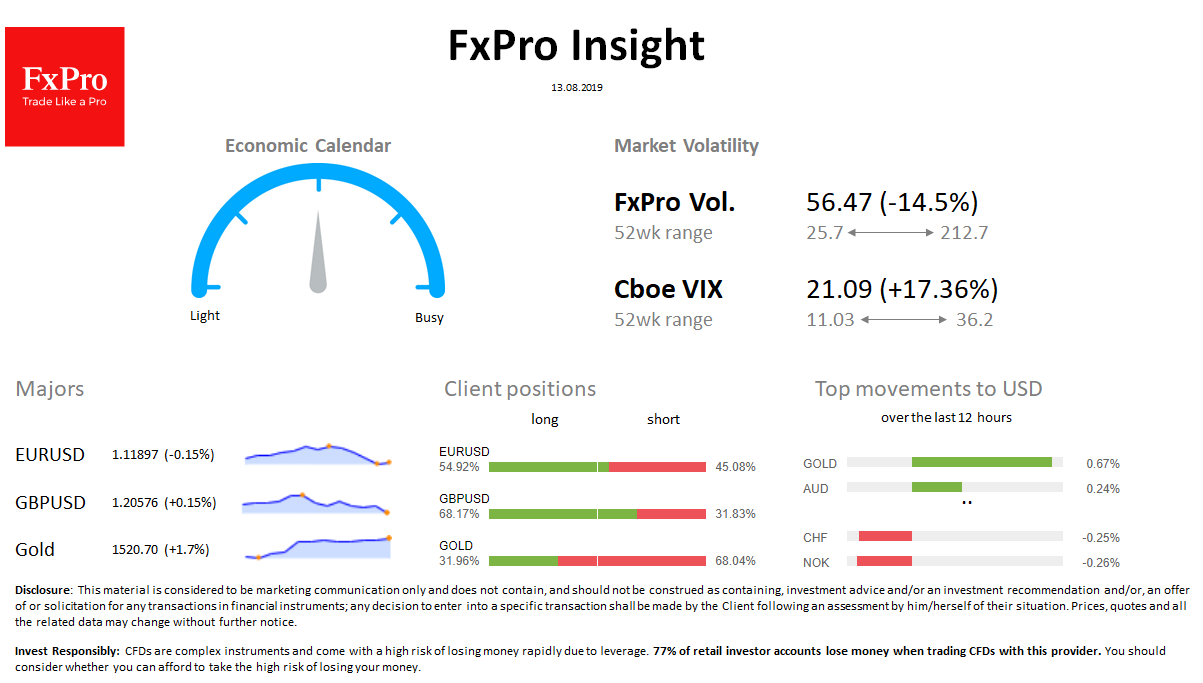

Market overview FX: The volatility of major currencies decreased, leaving EURUSD at 1.12 and GBPUSD at 1.2050, with peripheral currencies experiencing increased volatility: the Argentine peso fell 30% intraday, the Turkish lira and Chinese yuan are developing their decline.

Stocks: Key indices are stable after the failure the day before while maintaining a slight downward slope.

Commodities: Gold at the time of writing jumped to 1523 (+ 1.7% since the beginning of the week). Brent treads at $ 58.

Crypto: Bitcoin is at 11300 for the second day. Top-10 altcoins lose 0.5-2.5%.

Important upcoming events (GMT):

08:30 GBP [!!!] UK Claimant Count Change 09:00 EUR [!!] German ZEW Economic Sentiment 12:30 USD [!!!] US Consumer Price Index