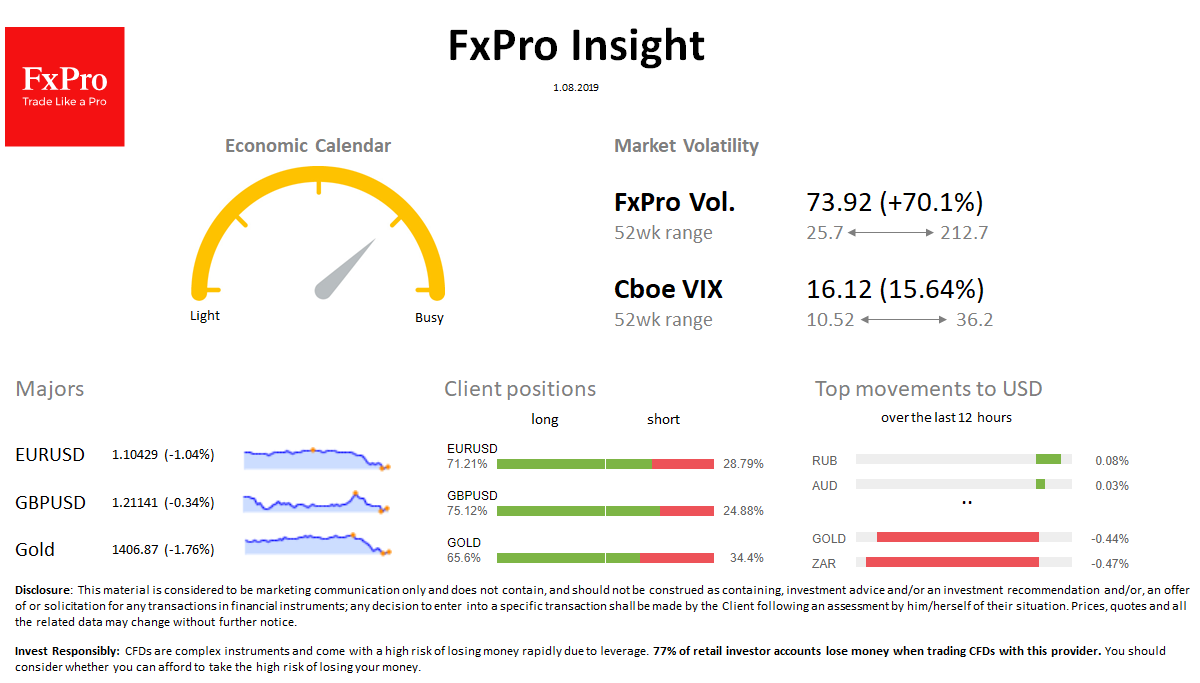

FX: The dollar adds about 0.8% to the basket of major currencies. GBPUSD at 1.21, near post Brexit referendum lows; EURUSD at 1.1050, gave up support at 1.1100.

Stocks: Stock markets lost more than 1% in the wake of Fed comments. In the morning there have been cautious purchases from local lows.

Commodities: Brent has stabilized at $64, as the dollar was opposed by news of falling US stocks. Gold has been sold off from $1,430 to $ 1,405.

Crypto: Bitcoin adds more than 2% over the last 24h but is experiencing difficulties with growth above 10,000. Major Altcoins drifting from -3% to +5%.

Important upcoming events (GMT):

14:00 UK [!!!] Bank of England Interest Rate Decision 15:30 US [ !!] Initial jobless claims 17:00 US [!!!] ISM Manufacturing PMI