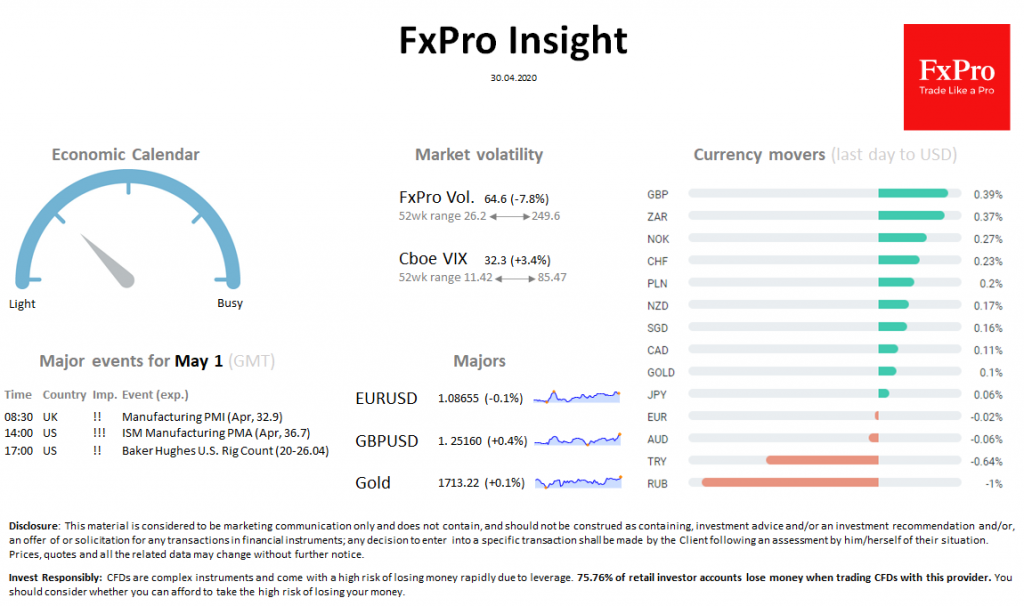

Market overview Futures on the SP500 lose 1.4% before the start of the New York trading session, turning sharply down in the last minutes. VIX adds by reflecting risk aversion in markets. DAX, CAC40 lose 1.1% each, FTSE100 drops 1.9%.

DXY turned up after touching at 99.5 amid weakening euro. From the beginning of the day, the demand for yielding assets prevailed, which resulted in a weakening dollar. However, the mood has changed as investors in Europe are careful before the long weekend.

Gold remains in the range of $1700-1715 the third day. Fixing positions at the end of the month puts pressure on quotes.

On intraday WTI charts, there are seen buying for the third day in a row, as in a line. Brent in the spot market stabilized at $26.4, after the jump at the start of the day.

ECB announced a cut in the TLTRO III program rate. The Central Bank pledges to pay banks 0.5% if they take money at a multi-year auction, and 1% if the money goes to the real sector.

Important events for May 1, GMT (Exp.): 08:30 UK !! Manufacturing PMI (Apr, 32.9) 14:00 US !!! ISM Manufacturing PMI (Apr, 36.7) 17:00 US !! Baker Hughes U.S. Rig Count (20-26.04)