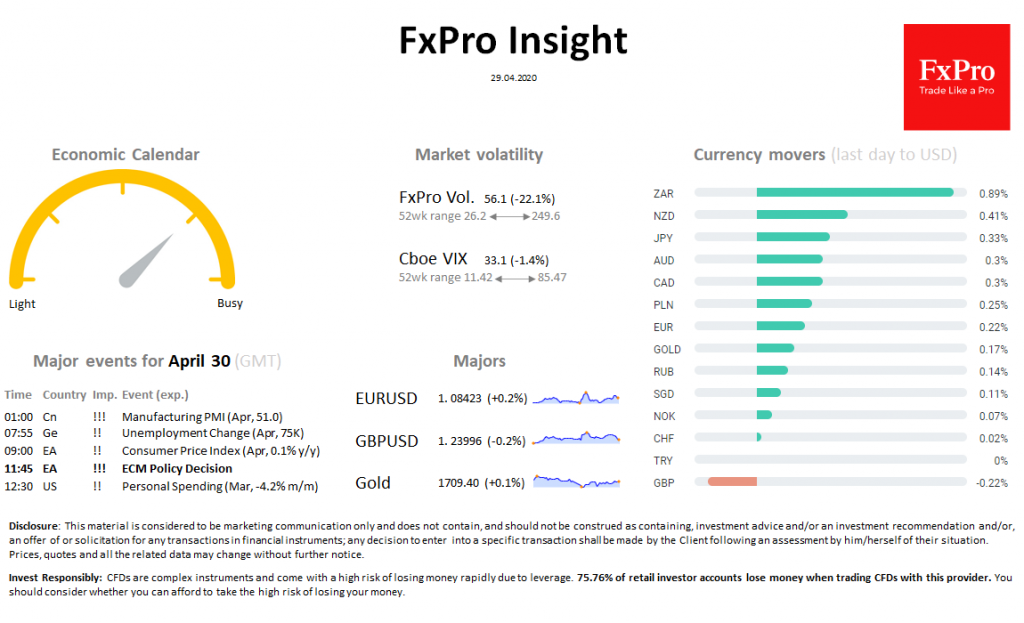

Market overview Futures on the SP500 added 1.1% before the start of the New York session closing almost unchanged the day before. Positive dynamics is provided by the gradual removal of restrictions on movement in various economies. The VIX index fell to levels at the beginning of March. DAX + 0.4%, CAC40 -0.1%, FTSE100 + 1%.

DXY is at 99.8, eased its downtrend. So far today, USD retreats to all major currencies except GBP. Foreign exchange market volatility returned to normal levels, reflecting a slowdown in capital flight from some markets.

Gold is trading near $1706, changing slightly over the past day. The positive mood of the markets at this stage suppresses the interest in insurance in the form of gold.

On the intraday oil charts, methodical purchases are visible for the second day in a row, as in the line. Brent in the spot market costs $24. Prices for the June contract erased decline at the start of the week.

The focus of the meeting is the Fed (tonight) and the ECB (tomorrow afternoon), which can cause severe movements in the markets.

Important events For April 30, GMT (Exp.): 01:00 Cn !!! Manufacturing PMI (Apr, 51.0) 07:55 Ge !! Unemployment Change (Apr, 75K) 09:00 EA !! Consumer Price Index (Apr, 0.1% y/y) 11:45 EA !!! ECB Policy Decision 12:30 US !! Personal Spending (Mar, -4.2% m/m)