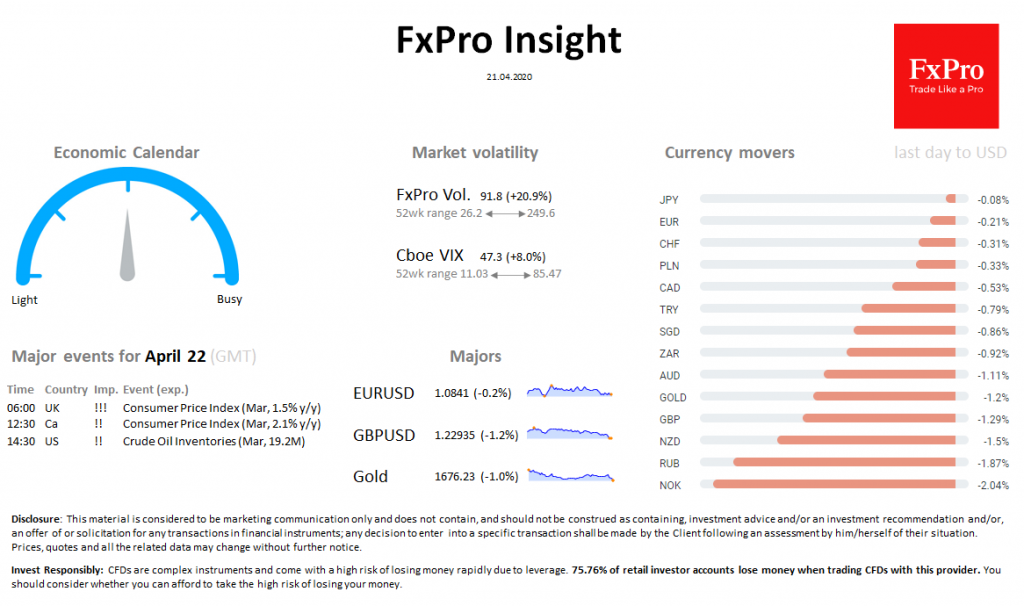

Market overview SP500 loses 2.1% at the start of trading on Tuesday after falling 2.2% a day earlier. Investors are concerned about the increase in volatility in oil and the weak earning reports. The VIX Index is growing to 48 – highs since April 3. DAX loses 2.9%, CAC40 minus 2.5%, FTSE100 -2%.

DXY has added 0.6% earlier today to 100.6, but turned sharply down 100.1 at the start of trading in the USA. Following the oil, RUB, NOK demonstrate a sharp decline. GBPUSD was down from 1.2430 to 1.2270, but rebounded to 1.2330. EURUSD since last Thursday reverses to growth with downturns to 1.0810.

Gold is trading at $1680, developing a rebound within a day after an earlier decline to $1660.

Brent fell below $21.65 (min since 2003), but received support later, bouncing to $24.

Increased volatility in oil increases the anxiety of markets regarding the sustainability of industry companies, spreading pessimism to the market as a whole. Growing expectations are that the markets have finished the rebound and are again turning down.

Important events for April 22, GMT (Exp.): 06:00 UK !!! Consumer Price Index (Mar, 1.5% y/y) 12:30 Ca !! Consumer Price Index (Mar, 2.1% y/y) 14:30 US !! Crude Oil Inventories (Mar, 19.2M)