On Friday, the currency market ensured that the dollar bulls were far from giving up important ground and only made a tactical retreat. The Dollar’s 1% strengthening in one day against the euro, its main rival, was a clear demonstration of strength.

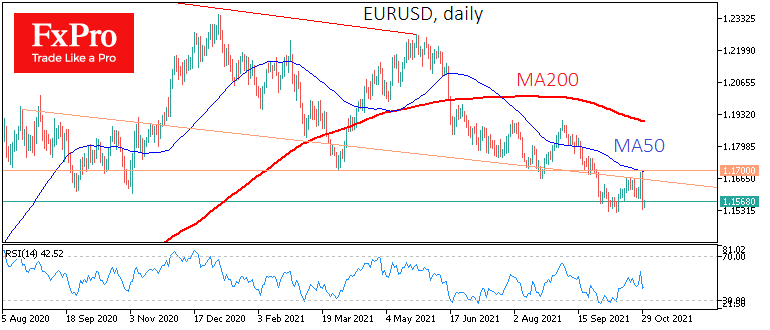

Currency traders crashed back the EURUSD as it approached 1.1700, a former significant support area. The pair’s recovery stopped just below the 50 simple moving average, which often indicates medium-term trends. It is worth noting how persistently the EUR has been selling from 50 SMA since June.

On the daily charts, the currency market got a significant signal of domination by the dollar bulls, forming a bearish takeover on the EURUSD.

Interestingly, on Friday, buyers in the stock markets managed to pull them into the green zone and close the month near all-time highs. Simultaneous buying in equities and a rising dollar is a rare and volatile combination.

We tend to think of the currency market as a more reliable indicator of changing trends. However, cautious traders would surely prefer to wait for a confirmation in EURUSD, falling below the local lows at 1.1530.

Investors, in general, would prefer to wait for signals from the fundamentals, with plenty of them happening this week.

On Wednesday, the US Fed will announce a decision on the key rate and the QE programme. The latter is expected to start tapering in November. Markets and Fed officials now expect QE to be entirely over by the middle of next year. These expectations are setting the trend for higher debt market interest rates. However, investors and traders will be watching the comments closely to adjust their expectations. And these changes have the potential to fundamentally affect the dynamics of the markets.

The other big news this week is the monthly labour market report. Market analysts are very cautious about employment growth, expecting to see around 400K new jobs — twice as many as was in September and above the long-term average. However, we cannot rule out upside surprises, as the end of additional unemployment benefits and higher inflation should stimulate the US to go back to work.

This is a favourable environment for the Dollar, which buyers could support in the coming weeks, developing an advance towards 1.1200 before the end of the year in the EURUSD and up to 97.5 in the USD Index from the current 1.1550 and 94.2 respectively. However, the biggest blow could come in emerging market currencies, where we could see a simultaneous winding down of the carry trade, profit-taking from previous gains and a shift of capital into dollar assets, which have become more profitable in recent weeks.

The FxPro Analyst Team