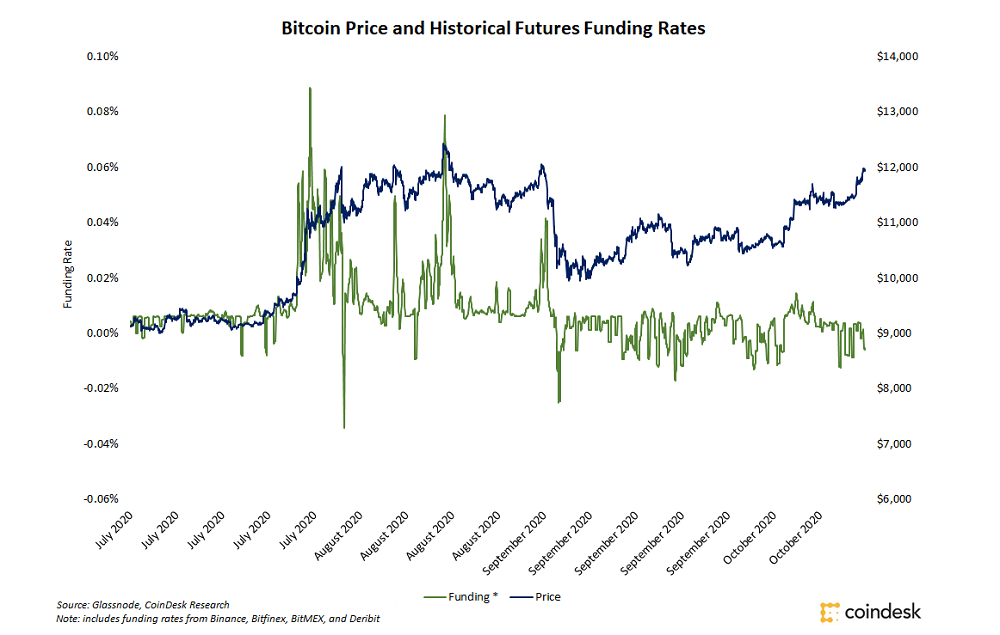

Cryptocurrency traders showed significantly less enthusiasm as bitcoin traded at $12,000 Tuesday compared to when bitcoin reached the same level nearly two months ago, based on futures funding rates from multiple exchanges. When bitcoin traded near $12,000 throughout August, finally reaching the key level mid-month, funding rates for perpetual futures turned acutely positive across leading derivative exchanges, reflecting the market’s bullishness.

As bitcoin revisited $12,000 Tuesday, however, funding rates reacted differently, staying flat or turning negative, indicating a lack of the same bullishness two months ago. A mechanism unique to perpetual futures contracts, funding rates are set by the market and vary over time as traders put on and take off positions. When the market is bullish, funding rates turn positive, and traders taking long positions pay short sellers. When the market is bearish, funding turns negative, and short sellers pay.

Funding rates across Binance, Bitfinex, BitMEX, and Deribit futures markets started turning negative Saturday and Sunday as bitcoin started trading above the low $11,000 levels, according to data aggregated by Glassnode. As bitcoin tapped $12,000 Tuesday, rates stayed negative or went flat. A string of negative news over the past few weeks may be to blame for the markets less-than-bullish sentiment, according to Aditya Das, cryptocurrency market analyst at Brave New Coin, who said he thinks some traders may have been “spooked” and closed their long positions or put on shorts. Funding on FTX and Huobi similarly stayed negative throughout the week’s entire opening rally, according to data aggregated by Skew.

Futures Traders Aren’t as Bullish This Time Around as Bitcoin Price Revisits $12,000, Data Indicates, CoinDesk, Oct 21