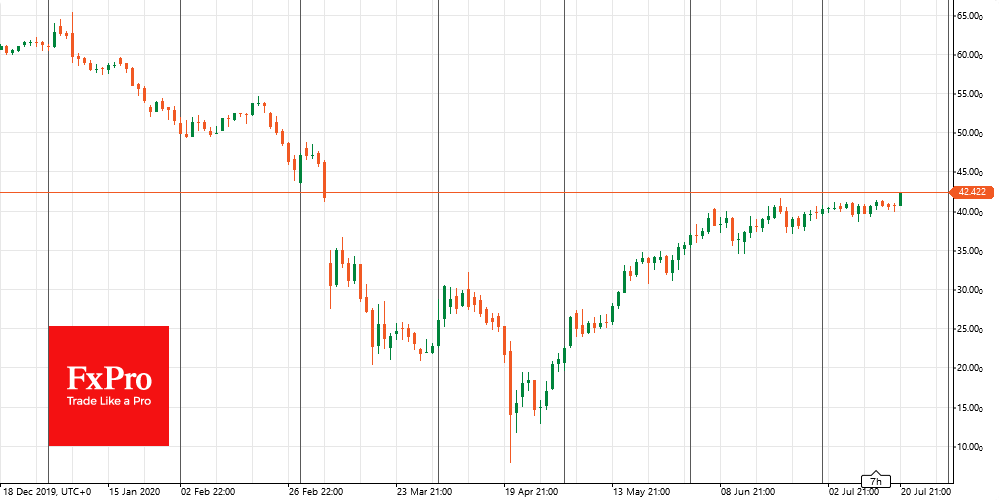

Gold went above $1840, which is only $80 below historic highs. Meanwhile, the most notable price action was seen in oil. WTI is up more than 3% to 42.40. With a rise above $41.70, oil closed the gap formed by the breakdown of the OPEC+ agreement and start of the price wars between Russia and Saudi Arabia. Since then, the two large suppliers have become friends again and agree on a roughly 20% production cap.

The revival of oil today is easily explained by short-term market reasons. Deliverable futures on the NYSE, where WTI is traded, expire today. Three months ago, this event caused a price collapse and a short-term dip of some futures into negative territory. Now, on the contrary, the increased activity of traders with short-term oil contracts pulls prices up.

These short-term factors force us to evaluate the prospects for further strengthening of prices with intense attention or extra attention. Three months ago, this event became a turning point for the markets.

The FxPro Analyst Team