The unwinding of the carry trade in the FX market continues, with the major safe havens returning to the extremes seen against the dollar in early August. A new wave of risk aversion has been synchronised across currency and equity markets since Tuesday. The S&P 500 has turned lower from the same levels and for the same reasons as a month and a half ago, but stocks are still far from the extreme lows of early last month.

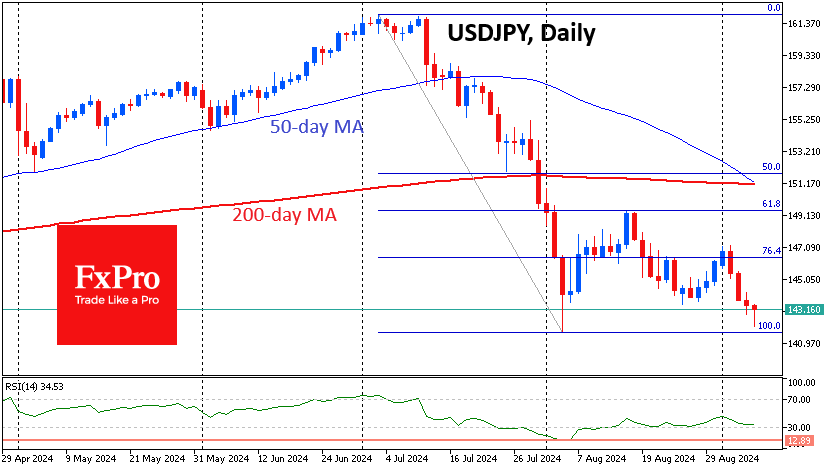

The picture is different in the carry trade-sensitive currency pairs, where the rally in the first half of August looks like a technical rebound that is almost complete. The USDJPY fell to 142.0 on Friday morning from a low of 141.7 on the 5th. Technically, the pair has completed a classic Fibonacci retracement, bouncing back to 61.8% of the initial decline. Adding to the pessimism is the formation of a ‘death cross’ as the 50-day average is about to fall below the 200-day. A renewal of the local lows below 142 triggers an expansion pattern with downside potential to 129 – back to the lows of late last year.

Although Switzerland is cutting rather than raising its key interest rate, buying the franc is more active. USDCHF at 0.8400 is already in the region of the 2023 lows but is still very cheap by historical standards. It traded below it for a few moments in January 2015 and for two months in mid-2011. On both occasions, the SNB intervened by reversing the appreciation of the local currency. It would be too simplistic to expect the central bank to intervene at these levels, but a strong franc almost guarantees, in our view, another rate cut at the upcoming rate decision on 26 September.

The Chinese yuan, a safe-haven newcomer, has already risen to 7.08 per dollar, its lowest level since the middle of last year. Low interest rates and weak Chinese growth have pushed the USDCNH higher for most of the year, but the trend has reversed since early July.

The rise in EURUSD over the past two months also fits into the unwinding of the carry trade explanation, as bond yields in major European countries have been lower than in the US.

Since the beginning of September and a month and a half ago, the dollar index and US stock indices have fallen simultaneously. The Fed will have to decide whether to maintain a more hawkish stance, allowing the dollar to strengthen again and putting pressure on the market, or cut rates sharply and support market and economic optimism at the expense of the dollar..

The FxPro Analyst Team